Take your VITA/TCE training online at

www.irs.gov

(key word: Link & Learn Taxes). Take the Foreign Student

and Scholar and other certication tests

VITA/TCE Foreign Student and Scholar Volunteer Resource Guide

Volunteer Income Tax Assistance (VITA) / Tax Counseling for the Elderly (TCE)

2023 RETURNS

Publication 4011 (Rev. 10-2023) Catalog Number 34182T Department of the Treasury Internal Revenue Service www.irs.gov

4 0 11

CONTACTS

Common Phone Numbers/ Web Addresses/ etc.

IRS-SPEC Relationship Manager:

TaxSlayer :

Site Coordinator:

Site Leader(s):

Forms, Instructions & Publications: www.irs.gov/forms-instructions

Tax Treaties: www.irs.gov/individuals/international-taxpayers/tax-treaties

Tax Treaty Tables: www.irs.gov/individuals/international-taxpayers/tax-treaty-tables

State Government Websites: www.irs.gov/businesses/small-businesses-self-employed/state-gov-

ernment-websites

State Contact(s):

Other Contacts

EFiling Form 1040-NR through TaxSlayer -

The latest information on the preparation of Forms 1040-NR through TaxSlayer can be found by going

to the VITA/TCE Springboard at vita.taxslayerpro.com and accessing the Pro Online Knowledge-

base or Pro Desktop Knowledgebase where you will nd the applicable lesson for completing the

Form 1040-NR using either version. (Search using key word “1040-NR ”).

1

Table of Contents

Important Changes for 2023 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Foreign Student/Scholar VITA-TCE Scope . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Tips for Filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Substantial Presence Test? - Decision Tree . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Resident or Nonresident Alien Decision Tree . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Resident or Nonresident Alien Decision Chart . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Form 13614-NR - Common Issues, Page 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Form 13614-NR - Common Issues, Page 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Unique Treaty Provisions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

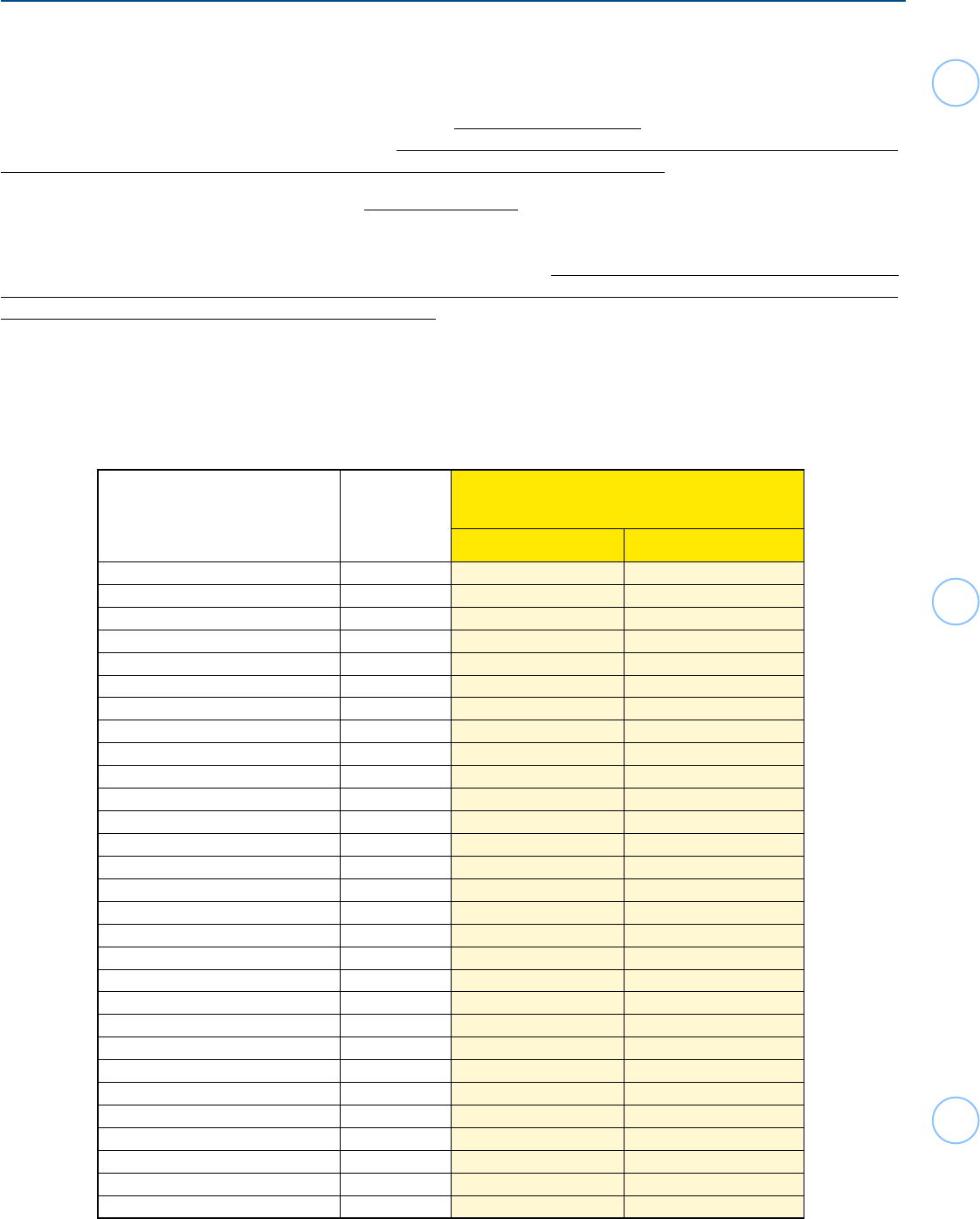

Countries with Treaty Benefits for Scholarship or Fellowship Grants (Income Code 16) . . . . . . . . 13

Countries With Treaty Benefits for Teaching and Research (Income Code 19) . . . . . . . . . . . . . . . . 14

Countries With Treaty Benefits for Studying and Training (Income Code 20) . . . . . . . . . . . . . . . . . 15

Capital Gains / Losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Dividend Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

State Income Tax Refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

How to Claim Treaty Benefits on Form 1040-NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Schedule OI - Income Exempt from Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Form 1042-S Foreign Person’s U.S. Income Subject to Withholding . . . . . . . . . . . . . . . . . . . . . . . . . 23

Filing Status . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Exemption Personal/Dependent Issues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Standard or Itemized Deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Wage Calculation Worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Tax Credits and Nonresident Aliens . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Social Security and Medicare Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

What Form(s) to File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

When to File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Where to File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Payment Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Source Documents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Additional Resources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

General Summary of U.S. Immigration Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Job Aid-Filers without an Individual Taxpayer Identification Number or Social Security Number . . 35

2

Tax Form Changes

ITINS

• ITINs not used in the last three consecutive tax years: Any ITIN that is not

used on a federal tax return for at least three consecutive tax years will expire on

December 31 of the third consecutive tax year of non- use.

• ITINs with middle digits (the fourth and fifth positions) “70,” “71,” “72,” “73,”

“74,” “75,” “76,” “77,” “78,” “79,”“80,” “81,” “82,” “83,” “84,” “85,” “86,” “87” or “88” have

expired. In addition, ITINS with middle digits “90,” “91,” “92,” “94,” “95,” “96,” “97,”

“98,” or “99” if assigned before 2013, have expired.

Exemptions/ Dependents

• The deduction for all personal exemptions is suspended (reduced to zero), effective

for tax years 2018 through 2025.

• For 2023, the gross income limitation for a qualifying relative remains at $4,700.

Standard Deduction

The standard deduction for qualifying residents of India who may choose not to itemize

deductions on Schedule A (Form 1040-NR) has increased. The standard deduction

amounts for 2023 are:

• $27,700 - Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,800)

• $13,850 - Single or Married Filing Separately (increase of $900)

Student loan interest deduction begins to phase out for taxpayers with MAGI in excess

of $75,000 ($155,000 for joint returns) and is completely phased out for taxpayers with

MAGI of $90,000 or more ($185,000 or more for joint returns).

Foreign Earned Income Exclusion

• For 2023, the maximum foreign earned income exclusion is $120,000.

Congress may enact additional legislation that will affect taxpayers after this

publication goes to print. Any changes will be reflected in Publication 4491-X, VITA /

TCE Training Supplement, available in mid-January on www.irs.gov.

Scholarship and Fellowship Grants Exclusion

Line 8r—Scholarship and fellowship grants not reported on Form W-2

Enter the amount of scholarship and fellowship grants not reported on Form W-2, reduced

by the total amount exempt by treaty. However, if you were a degree candidate at an eligible

educational organization, generally include on line 8r only the amounts you used for

expenses other than tuition, fees, and required, course-related expenses. For

example, amounts used for room, board, and travel must be reported on line 8r.

Attach any Form(s) 1042-S you receive from the educational organization to page

1 of the Form 1040-NR. Scholarship and fellowship grants are reported in box 2 of

Form 1042-S.

Important Changes for 2023

3

For more information about tax requirements for scholarships and fellowships, see Pub. 519

and chapter 1 of Pub. 970.

Under some treaties, scholarship or fellowship grant income is not exempt from

tax if the income is received in exchange for the performance of services, such

as teaching, research, or other services. Also, many tax treaties do not permit an

exemption from tax on scholarship or fellowship grant income unless the income is from

sources outside the United States. If you are a resident of a treaty country, you must

know the terms of the tax treaty between the United States and the treaty country to

claim treaty benefits on Form 1040-NR. See the instructions for item L of Schedule OI,

later, for details.

Example 1. You are a citizen of a country that does not have an income tax treaty in force

with the United States. You are a candidate for a degree at ABC University (located in the

United States). You are receiving a full scholarship from ABC University. You are not required

to perform any services, such as teaching, research, or other services, to get the scholarship,

and you have no other sources of income. The total amounts you received from ABC University

during 2022 are as follows:

Tuition and fees $25,000

Books, supplies, and equipment 1,000

Room and board 9,000

$35,000

The Form 1042-S you received from ABC University for 2022 shows $9,000 in box 2 and

$1,260 (14% of $9,000) in box 10.

Note. Box 2 shows only $9,000 because withholding agents (such as ABC University) are not

required to report section 117 amounts (tuition, fees, books, supplies, and equipment) on Form

1042-S.

You would enter $9,000 on line 8r of Schedule 1 (Form 1040) only.

Example 2. The facts are the same as in Example 1, except that you are a citizen of a country

that has an income tax treaty in force with the United States that includes a provision that

exempts scholarship income and you were a resident of that country for income tax purposes

immediately before arriving in the United States to attend ABC University. Also, assume that,

under the terms of the tax treaty, you are present in the United States only temporarily to finish

your degree, and all of your scholarship income is exempt from tax because ABC University is

a nonprofit educational organization.

When completing your tax return, do the following.

Provide all the required information in item L of Schedule OI (Form 1040-NR). Enter the $9,000

shown in box 2 of Form 1042-S into column (d) of the schedule.

Enter $9,000 from box L1(e) of Schedule OI (Form 1040-NR) on line 1k of Form 1040-NR.

Enter $1,260 on line 25g of Form 1040-NR to report the withholding shown in box 10 of Form

1042-S.

For this example, you will not enter any amount on line 8r of Schedule 1 (Form 1040)

because the entire scholarship income shown in box 2 of Form 1042-S is exempt from

tax by the treaty.

4

Foreign Student/Scholar VITA-TCE Scope

The scope of the Foreign Student and Scholar Volunteer Income Tax Assistance Program is

limited to only those areas of tax law specifically addressed in your Link and Learn training.

This occurs for many reasons:

1. It is one of our Quality Site Requirements: standards proven to provide the most consistent

quality services to the taxpayers.

2. As a volunteer you are only covered for liability while preparing returns within your IRS

certification level.

3.

Many areas of tax law, specifically treaty issues and nonresident alien issues, can be very

time consuming and would prevent the program from assisting other taxpayers with less

complex returns.

4. The VITA program should be consistent across the nation and around the globe. Services

offered in one site generally should be the same as those offered at other sites which have

volunteers of the same certification level.

If your site finds that Foreign Students and/or Scholars have similar Out of Scope issues,

you may want to refer them to other free services that can help them or advise them to seek

the services of a professional tax preparer.

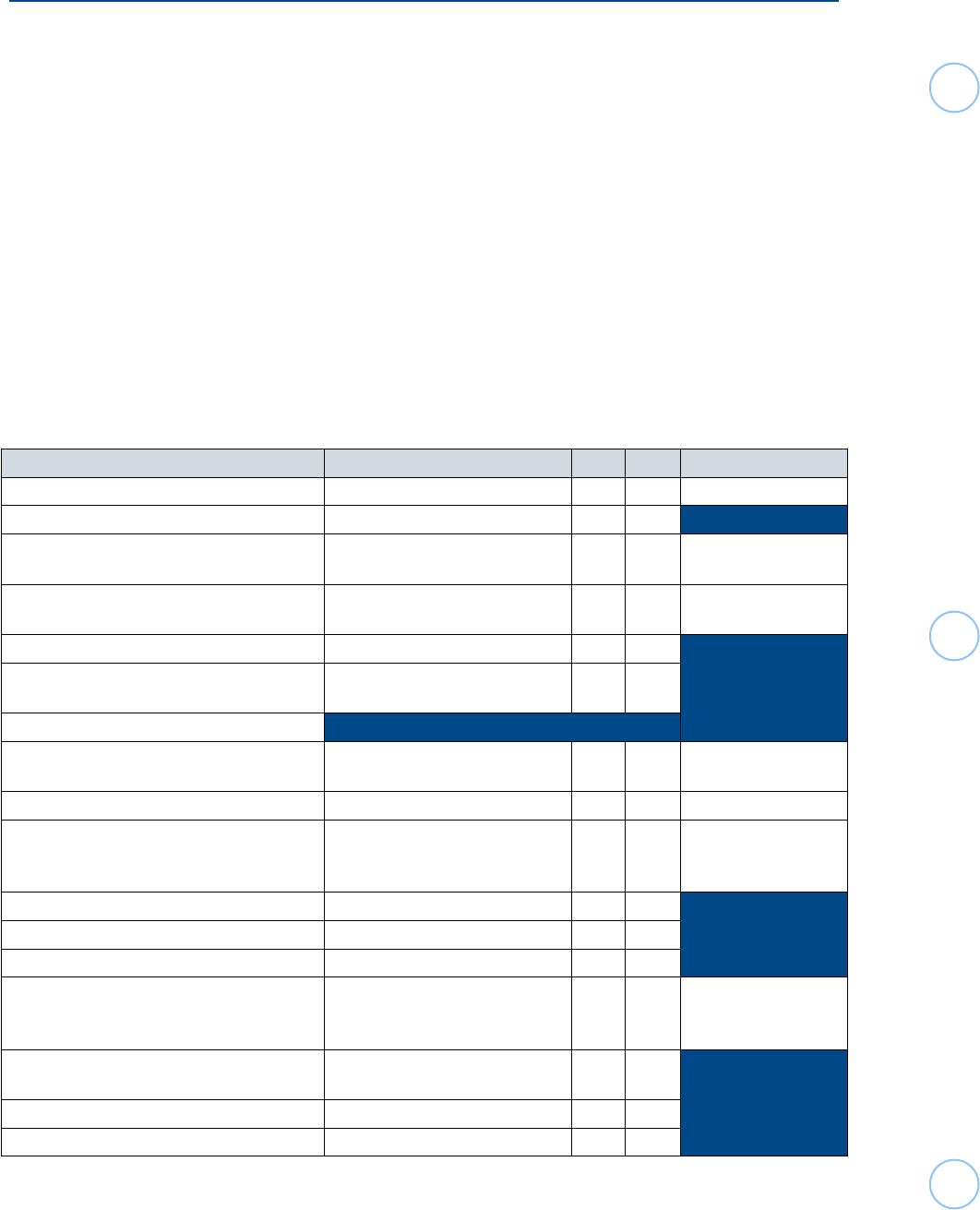

Types and Sources of Income

Income type Source is determined by IN OUT FORM 1040-NR

Dividends, with no applicable treaty benefits Where payer is incorporated X Schedule NEC

Interest - general business/investment Payer’s place of residence X

Interest - Not Effectively Connected to a U.S.

Trade or Business

Payer’s place of residence X Schedule NEC

Interest - Personal Account from a Banking

Institution

Payee’s place of residence X* Not taxable in U.S.

Gambling winnings Payer’s place of residence X

Non-Employee Compensation/ Self Employ-

ment (Form 1099-NEC, etc.)

Where services are performed X

Pension or Annuity payments attributable to:

Contributions (employer or employee, pretax)

/ Earnings of domestic (U.S.) trusts

Where the services were per-

formed/The U.S. is the source

X* Line 5a/5b

IRA distributions The U.S. is the source X* Line 4a/4b

Refunds of State & Local Income Taxes The U.S. is the source X*

Form 1040, Schedule 1,

Then Form 1040-NR,

Line 8

Rents Where property is located X

Royalties from natural resources Where property is located X

Royalties from patents, copyrights, etc. Where property is used X

Salaries, wages, and other compensation for

personal services (Listed on Forms W-2 and

1042-S codes 19 and 20)

Where services are performed X* Line 1a

Sale of inventory that was purchased Where the inventory is sold

(Where title passes)

X

Sale of personal property (except inventory) Tax home of seller X

Sale of real property Where the property is located X

* U.S. Source Only is within scope

5

Foreign Student/Scholar VITA-TCE Scope

Types and Sources of Income

Income type Source is determined by IN OUT FORM 1040-NR

Taxable Scholarships and fellowships Residence of grantor X* Form 1040,

Schedule 1, Then

Form 1040-NR, Line 8

Social Security Benefits (U.S.)

Where the services were performed

X* Schedule NEC

Stock sales (Capital Gains/ Losses) sales

under $10,000

Where payer is incorporated X*

A

Schedule NEC

Unemployment Compensation Payer’s place of residence X Form 1040,

Schedule 1

Student Loan Interest Where services are performed X Form 1040,

Schedule 1

Educator Expenses, Health Savings Account,

and IRA Deductions

(Unless VITA Basic or Advanced

certified)

X

A

Form 1040,

Schedule 1

Self-Employment Tax, SEP, Penalty on Early

Withdrawal of Savings, etc. not covered in

Foreign Student Scholar Training

(Due to the complexity of these

issues for Nonresident Aliens and

possible treaty provisions, etc.)

X

Deductions:

State & Local Income Taxes U.S. Only X Form 1040-NR,

Schedule A

Gifts to U.S. Charities U.S. Only X

Form 1040-NR,

Schedule A

Casualty & Theft Losses X

Certain Misc. Deductions (Only to the extent included in the

Training Materials.)

X Form 1040-NR,

Schedule A

Medical, Mortgage Interest, Property Taxes,

etc. not listed on Form 1040-NR, Sch. A

X

Other:

Form 1095-A - Premium Tax Credits (Nonresidents are not eligible,

repayments are Out of Scope.)

X

Dual Status Residency X

Treaty Provisions claimed by a Resident Alien X

Refunds of Social Security Taxes erroneously

withheld (Form 843)

X See Form 843

Election to be treated as a Resident to file

MFJ with resident spouse

(Election Statement is Out of

Scope)

X**

Claim of “Closer Connection” or “Dual” Status X

Form W-7, ITIN Application X***

* U.S. Source Only is within scope

** A paper return can be done by a VITA/TCE site, but the election/attachment is Out of Scope.

***Only a qualied CAA site can prepare these to be sent with the return.

A

Advanced certication is also required. Refer to treaty for possible further restrictions.

6

Tips for Filing

Foreign students and scholars will have one of three statuses for tax purposes:

• Resident: U.S. residents who meet either the green card test or the substantial presence test

• Nonresident: Persons who are not U.S. citizens or lawful permanent residents of the United

States

• Dual status: Persons who are both nonresidents and resident aliens in the same tax year

(Out of Scope)

If you are an exempt individual for the Substantial Presence Test you will generally file using

Form 1040-NR.

If you must apply the Substantial Presence Test and are determined to be a Resident Alien,

the normal rules and procedures for filing a Form 1040 should be followed.

If you must apply the Substantial Presence Test and are determined to be a Nonresident Alien,

you will generally file using Form 1040-NR.

1. Nonresident students, teachers, or trainees who are temporarily in the U.S. in F, J, M, or Q

immigration status must file returns if they have income that is subject to withholding, whether

tax is withheld or not.

2. Nonresident aliens claiming treaty benefits must also file a return.

Form 8843 - Who Must File

If you are an alien individual (other than a foreign government-related individual), you must file

Form 8843 yearly (for yourself and all family members in the U.S. in F-2 or J-2 immigration

status) to explain the basis of your claim that you can exclude days of presence in the United

States for purposes of the substantial presence test.

Foreign scholars or students (with or without income) excluding days of presence in the United

States because you fall into any of the following categories, must file a fully completed Form

8843.

• You were unable to leave the United States as planned because of a medical condition

or problem.

• You were temporarily in the United States as a teacher or trainee on a “J” or “Q” visa.

• You were temporarily in the United States as a student on an “F,” “J,” “M,” or “Q” visa.

7

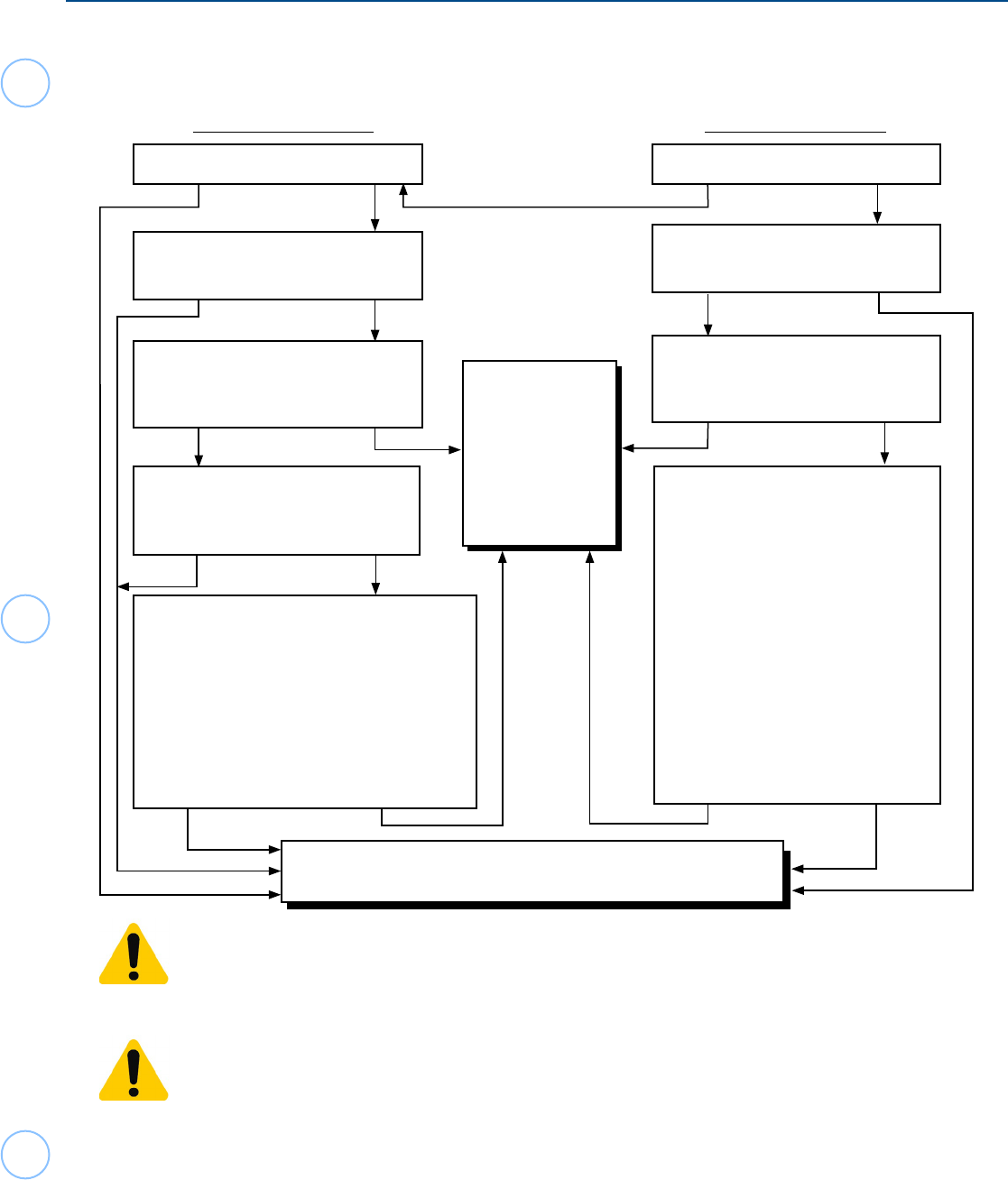

Substantial Presence Test? - Decision Tree

If you are temporarily present in the United States on an F, J, M, or Q visa, use this chart to determine if

you are an exempt individual for the Substantial Presence Test (SPT).

Do not count the following as days of presence in the United States for the substantial

presence test: Days you are an exempt individual.

If additional days of presence due to COVID-19 travel restrictions cause the taxpayer to

become a “resident” using the physical presence test rules, see possible exceptions allowed

in Revenue Procedure 2020-20.

Do you choose to claim a Closer

Connection exception to the

Substantial Presence Test?

Were you exempt as a teacher,

trainee, or student for any part of 3 (or

fewer) of the 6 preceding years, AND

Did a foreign employer pay all your

compensation during the tax year in

question, AND Were you present in

the U.S. as a teacher or trainee in

any of the preceding 6 years, AND

Did a foreign employer pay all your

compensation during each of the

preceding 6 years you were present in

the U.S. as a teacher

or trainee?

In order to claim the exception, all the

following must apply:

A. You do not intend to reside

permanently in the US

B. You must have complied with your Visa.

C. You must not have taken steps to

become a Resident Alien.

D. You must have a closer connection

to a foreign country.

No Yes

No Yes

NoYes

* You

must apply the Substantial Presence Test

using the Resident or Nonresident Alien Decision Tree

Student

F, J, M, or Q Visa

Teacher or Trainee

J Visa

Are you a student?Are you a full-time student?

Are you in substantial

compliance with your visa?

Are you in substantial

compliance with your visa?

Were you exempt as a teacher,

trainee, or student for any part of

more than 5 calendar years?

Were you exempt as a teacher,

trainee, or student for any part of 2

of the preceding 6 calendar years?

You are

an exempt

individual for the

Yes

No

Yes

No

No Yes

No Yes

No Yes

Yes No

Substantial

Presence Test

and will file

Form 1040-NR

8

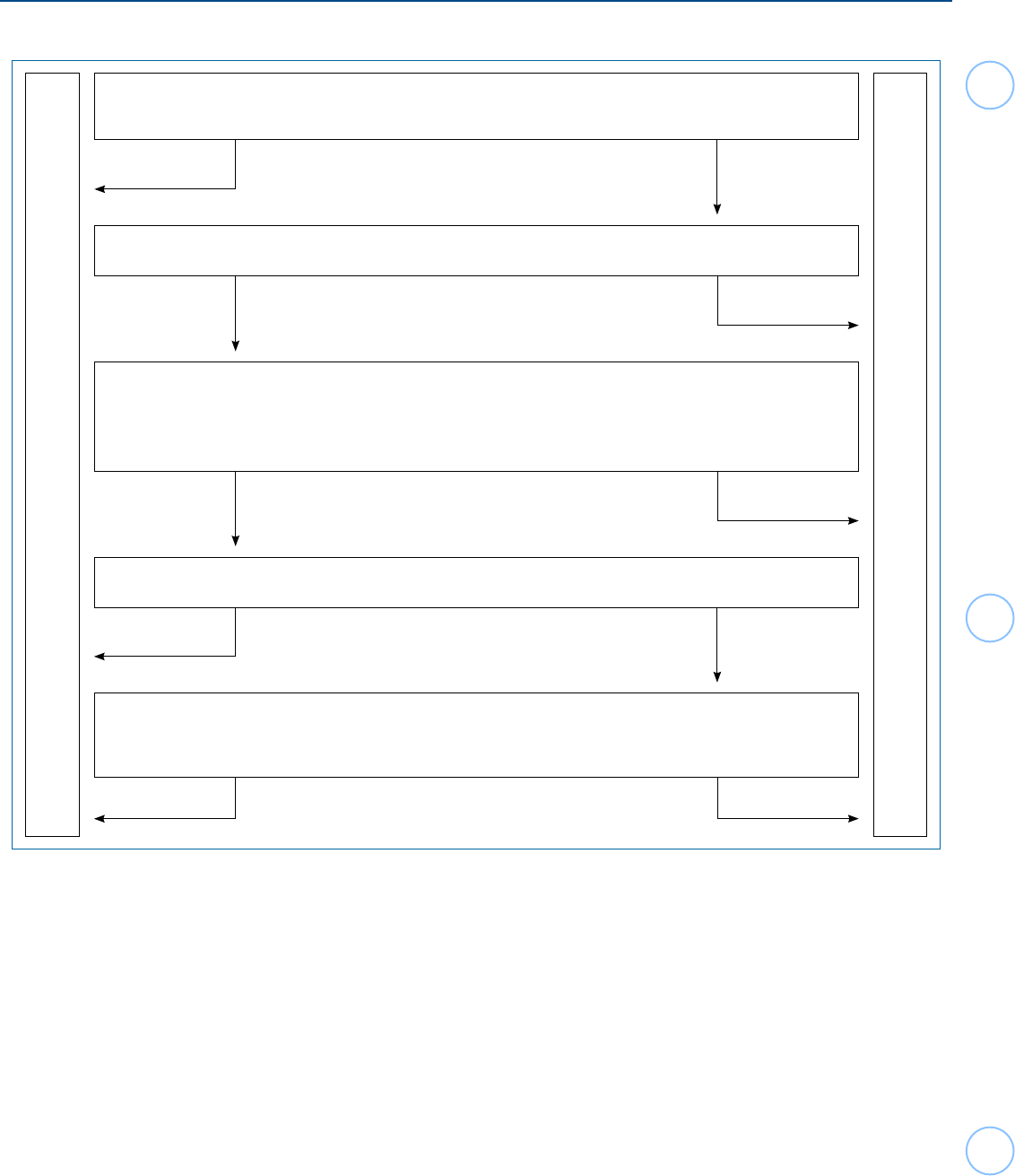

Resident or Nonresident Alien Decision Tree

Start here to determine your residency status for federal income tax purposes

Were you a lawful permanent resident of the United States (“had a green card”) at any

time during the current tax year?

1

YES NO

Were you physically present in the United States on at least 31 days during the current

tax year?

3

YES NO

Were you physically present in the United States on at least 183 days during the 3-year

period consisting of the current tax year, and the preceding 2-years, counting all days of

presence in the current tax year. 1/3 of the days of presence in the first preceding year.

and 1/6 of the days of presence in the second preceding year?

3

YES NO

4

Were you physically present in the United States on at least 183 days during the

current tax year?

3

YES NO

Can you show that for the current tax year you have a tax home in a foreign country

and have a closer connection to that country than to the United States? (*Out of

Scope, Form 8840 required)

NO YES

5

1

If this is your rst or last year of residency, you may have a dual status for the year. See Dual-Status Aliens in Pub 519. (Out of

Scope)

2

In some circumstances you many still be considered a nonresident alien and eligible for benets under an income tax treaty

between the U.S. and your country. Check the provision of the treaty carefully (Must be certied appropriately).

3

See Days of Presence in the United States in Pub 519 for days that do not count as days of presence in the U.S. (Exempt

individuals such students, scholars, and others temporarily in the U.S. under an F, J, M, or Q visa’s immigration status do not count

their days of presence in the U.S. for specied periods of time).

4

If you meet the substantial presence test for the following year, you may be able to choose treatment as a U.S. resident alien for

part of the current tax year. See Presence Test under Resident Aliens and First-Year Choice under Dual Status Aliens in Pub. 519.

(Out of Scope).

5

Nonresident students from Barbados, Hungary, and Jamaica, as well as trainees from Jamaica, may qualify for an election to be

treated as a U.S. Resident for tax purposes under their tax treaty provisions with the U.S. A formal, signed, election statement

must be attached to the Form 1040 (preparation of the statement is Out of Scope). (It continues until formally revoked).

RESIDENT Alien for U.S. Tax Purposes

1,2

NONRESIDENT Alien for U.S. Tax Purposes

9

Resident or Nonresident Alien Decision Chart

Determine residency status for federal income tax purposes.

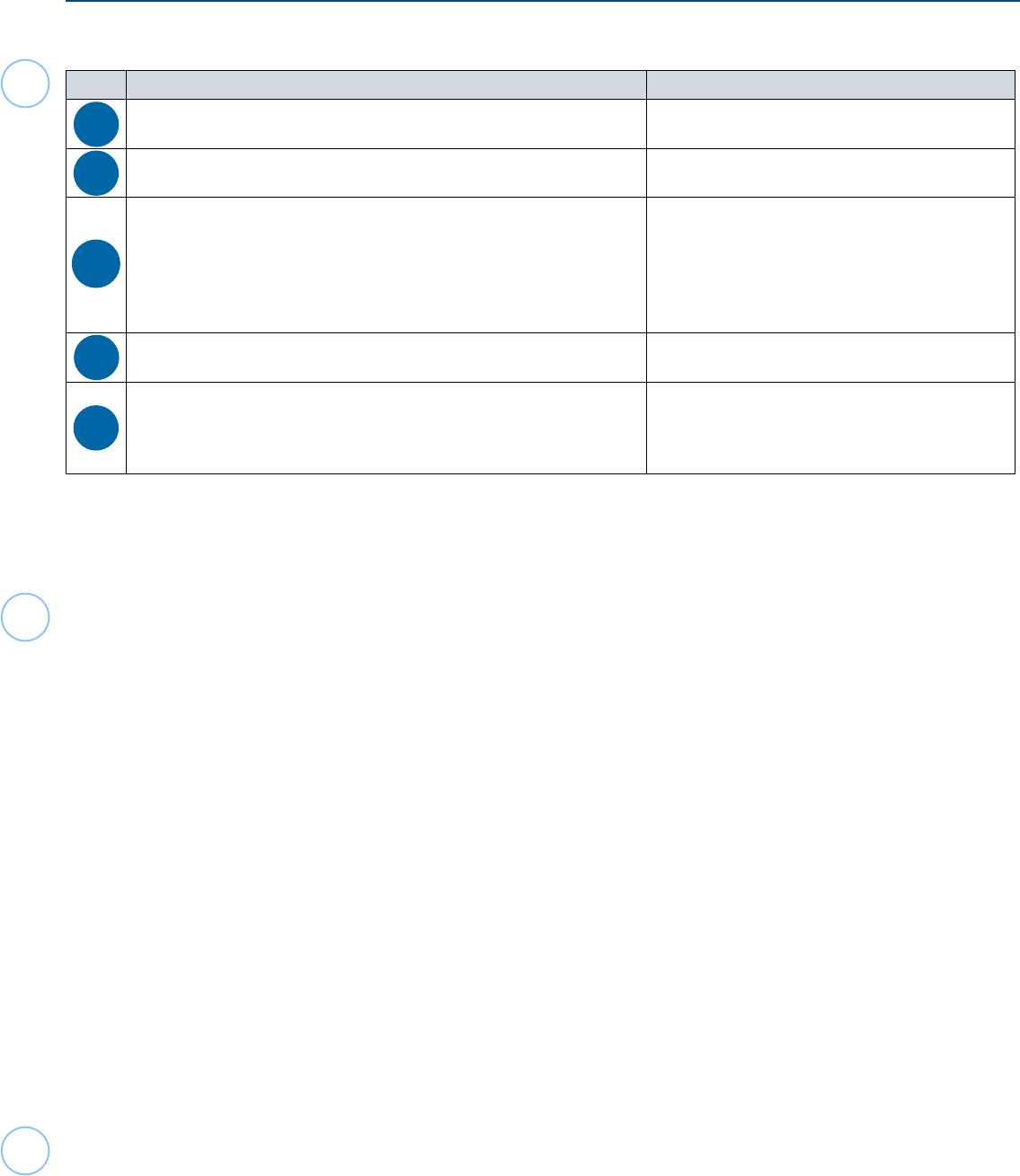

Step Probe/Ask the taxpayer Action

1

Were you a lawful permanent resident of the United States (had a “green

card”) at any time during the current tax year?

YES – RESIDENT Alien for U.S. tax purposes

1,2

NO – Go to Step 2

2

Were you physically present in the United States on at least 31 days

during the current tax year?

3

YES – Go to Step 3

NO – NONRESIDENT Alien for U.S. tax purposes

5

3

Were you physically present in the United States on at least 183 days

during the 3-year period consisting of the current tax year and the

preceding 2 years,

counting all days of presence in the current tax year,

1/3 of the days of presence in the first preceding year, and

1/6 of the days of presence in the second preceding year?

3

YES – Go to Step 4

NO – NONRESIDENT Alien for U.S. tax purposes

4,5

4

Were you physically present in the United States on at least 183 days

during the current tax year?

3

YES – RESIDENT Alien for U.S. tax purposes

1,2

NO – Go to Step 5

5

Can you show that for the current tax year you have a tax home in a

foreign country and have a closer connection to that country than to the

United States? *(Out of Scope, Form 8840, Closer Connection Exception

Statement for Aliens required)

YES* – NONRESIDENT Alien for U.S. tax purposes

5

NO – RESIDENT Alien for U.S. tax purposes

1,2

1

If this is your rst year of residency, you may have a dual status for the year. See Dual Status Aliens in Pub 519, U.S. Tax Guide

for Aliens. (Out of Scope)

2

In some circumstances you may still be considered a nonresident alien and eligible for benets under an income tax treaty

between the U.S. and your country. Check the provision of the treaty carefully. (Out of Scope)

3

See Days of Presence in the United States in Publication 519 for days that do not count as days of presence in the U.S. (Exempt

individuals such as students, scholars, and others temporarily in the U.S. under an F, J, M, or Q visa’s immigration status do not

count their days of presence in the U.S. for specied periods of time.)

4

If you meet the substantial presence test for the following year, you may be able to choose treatment as a U.S. resident alien for

part of the current tax year. See Substantial Presence Test under Resident Aliens and First Year Choice under Dual Status Aliens

in Publication 519. (Out of Scope)

5

Nonresident students from Barbados, Hungary, and Jamaica, as well as trainees from Jamaica, may qualify for an election to be

treated as a U.S. Resident for tax purposes under their tax treaty provisions with the U.S. A formal, signed, election statement

must be attached to the Form 1040 (preparation of the statement is Out of Scope). (It continues until formally revoked.)

If after using the Resident or Nonresident Alien Decision Tree you have determined a taxpayer is a Resident

Alien for U.S. Tax Purposes, and does not meet any of the exceptions that would be outside of the scope of

the VITA program, select one of the filing statuses listed under the Basic Information Section in TaxSlayer

Pro. A Resident Alien is treated like a U.S. Citizen when determining filing status.

If after using the Resident or Nonresident Alien Decision Tree you have determined a taxpayer is a

Nonresident Alien for U.S. Tax Purposes, as the initial return screen opens or under the Basic Information

Section in TaxSlayer Pro, select Nonresident Alien, if you have certified under the Foreign Student and

Scholar Module and the taxpayer’s circumstances are within the scope of the Foreign Student and Scholar

VITA program. After selecting the Nonresident Alien filing status, you will be given three (3) choices; Single

nonresident alien, Married nonresident alien, or Qualifying Surviving Spouse.

You will only complete a tax return for a Nonresident Alien if you have certified on the Foreign Student and

Scholar Module, and at least 1 other person at your site, who is also certified on the Foreign Student and

Scholar Module, can quality review the return.

10

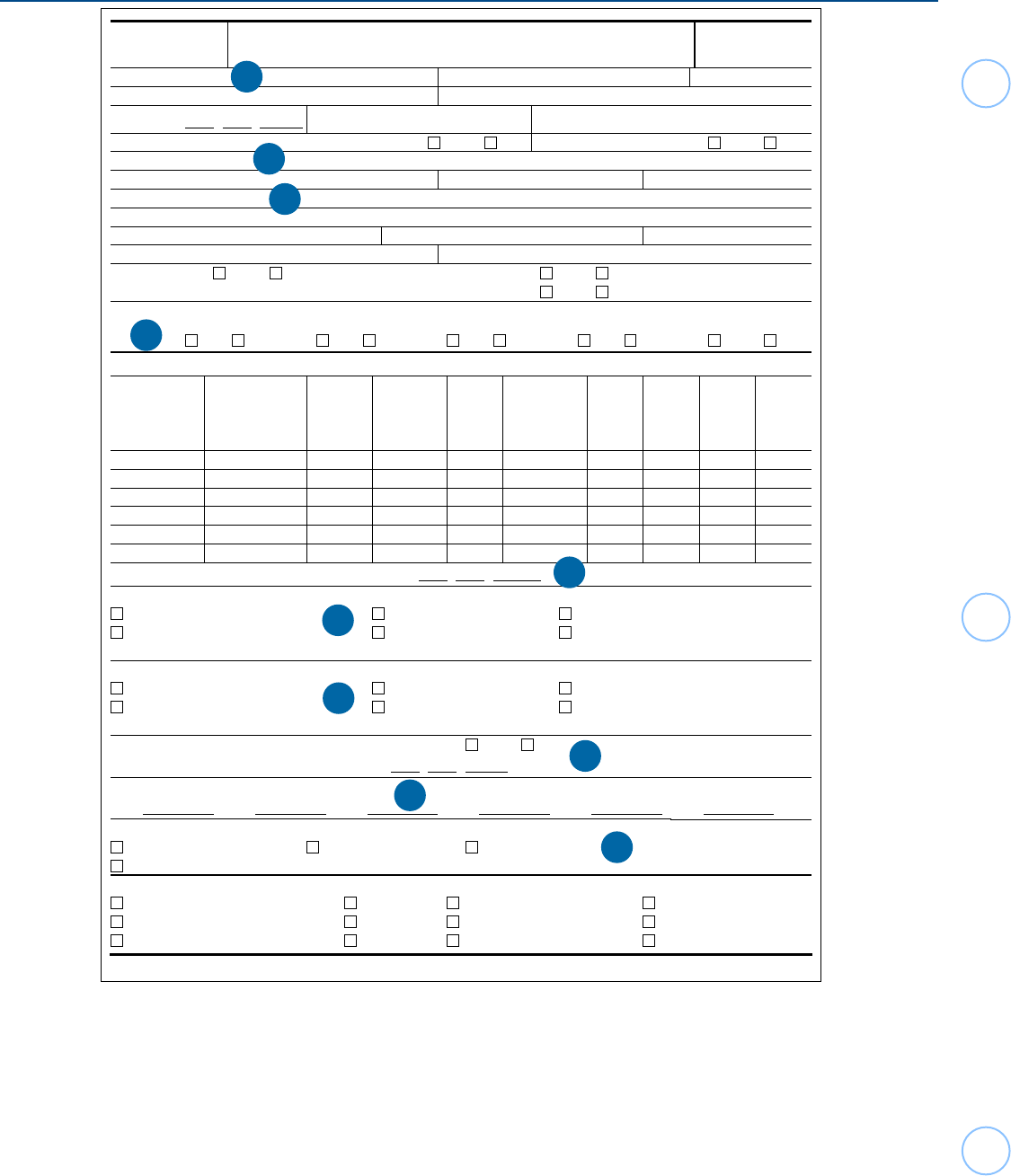

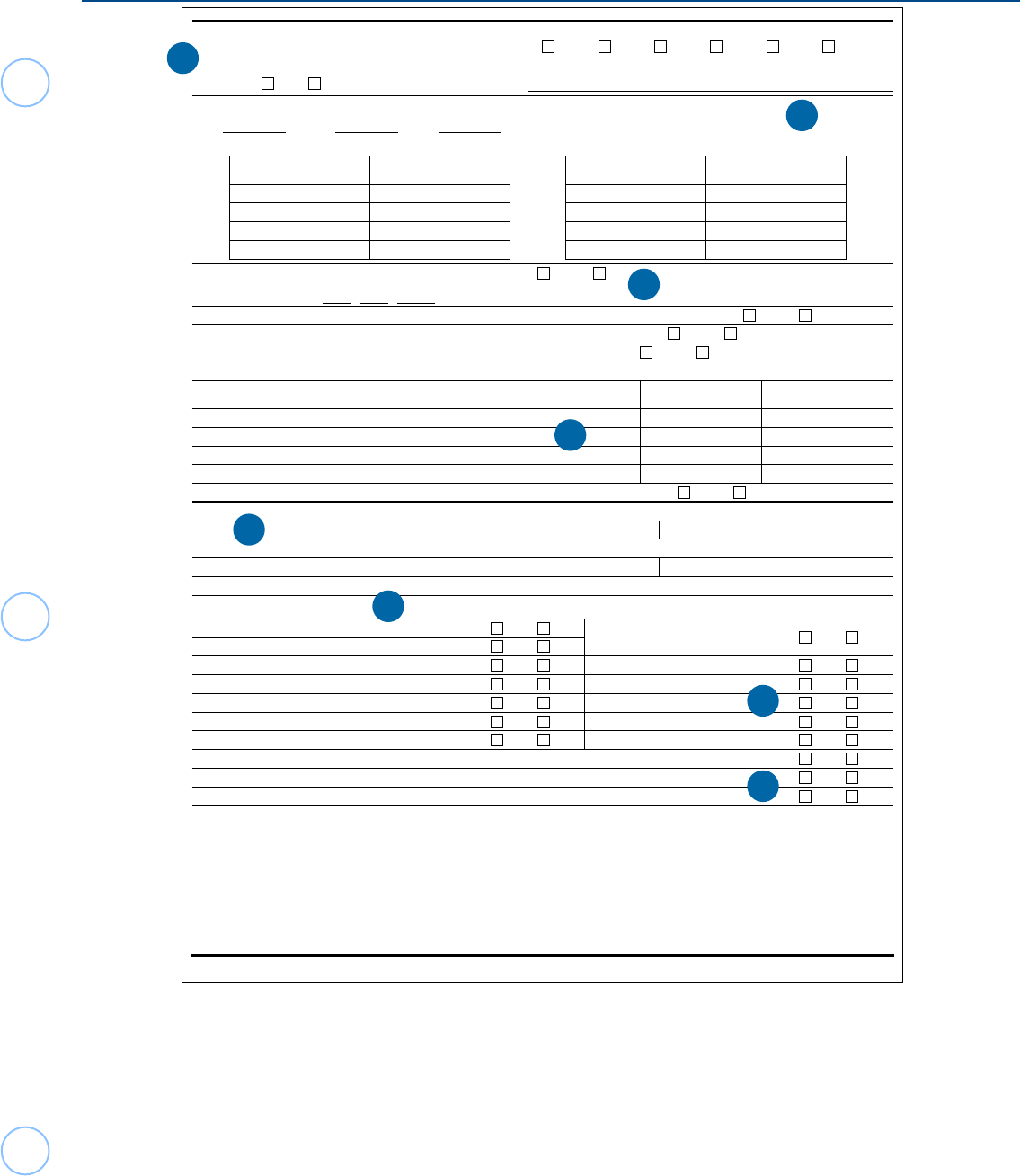

Form 13614-NR - Common Issues, Page 1

Catalog Number 39748B www.irs.gov

Form

13614-NR (Rev. 5-2023)

Form 13614-NR

(May 2023)

Department of the Treasury - Internal Revenue Service

Nonresident Alien Intake and Interview Sheet

OMB Number

1545-1964

Last or family name First Middle initial

Visa # Passport #

Date of birth:

(mm/dd/yyyy)

/ /

Telephone # E-mail address

Were you a U.S. citizen or resident alien the entire year? Yes No Were you ever a U.S. citizen? Yes No

U.S. local street address

City State Zip code

Foreign residence address

Address line 2

Foreign country Province/County Postal code

Country of citizenship Country that issued passport

Are you married?

Yes No If “YES”, is your spouse in the U.S.? Yes No

If "YES", is it recognized by the state where you will be filing? Yes No

Are you a U.S. National

Yes No

Resident of

Canada

Yes No

Resident of

Mexico

Yes No

Resident of

South Korea

Yes No

Resident of

India

Yes No

Dependent Information

First name

Last or

family name

Date of birth

(mm/dd/yyyy)

Relationship

to you (son,

daughter,

none, etc.)

Number of

months lived

with you in

the

U.S. in 2023

U.S. citizen,

U.S. resident alien,

U.S. national,

or a resident of

Canada, Mexico, or

South Korea

Did

person file

joint return?

Did person

provide

more than

50% of their

own

support?

Did you

provide

more than

50% of their

support?

Did the

person

have Gross

Income of

$4,700 or

more?

What is the date you FIRST entered the United States?

/ /

Entry Immigration Status - Check one

U.S. Immigrant/Permanent resident F-1 Student F-2 Spouse or child of student

H-1 Temporary employee *J-1 Exchange visitor J-2 Spouse or child of exchange visitor

Other (list)

Current Immigration Status - Check one

U.S. Immigrant/Permanent resident F-1 Student F-2 Spouse or child of student

H-1 Temporary employee *J-1 Exchange visitor J-2 Spouse or child of exchange visitor

Other (list)

Have you ever changed your visa type or U.S. immigration status? Yes No

If “Yes”, indicate the date and nature of the change.

/ /

Enter the type of U.S. visa you held during these years

2017 2018 2019 2020 2021

2022

* If Immigration status is J-1, what is the subtype? Check one

01 Student

02 Short term scholar

05 Professor 12 Research scholar

Other

(list)

What is the actual primary activity of the visit? Check one

01 Studying in a degree program

02 Studying in a non-degree program

03 Teaching

04 Lecturing

05 Observing

06 Consulting

07 Conducting research

08 Training

09 Demonstrating special skills

10 Clinical activities

11 Temporary employment

12 Here with spouse

1

2

3

4

5

6

7

8

9

10

1. Name should match that on Passport or Visa.

2. Taxpayer’s current address where the IRS should mail refund and/or other correspondence.

3. This is the student’s address back home, typically where the parents live. Needed if refund is to be mailed to foreign

address.

4. The answers are needed to determine if certain treaties apply. This applies to Schedule OI, Other Information.

5. Date first entered as a student/scholar.

6. Typically listed on the student/scholar’s original entry visa. Ask, as it may no longer be in the passport.

7. Current immigration status may have changed since entering the U.S. This may be needed on Schedule OI in Tax

Slayer if a treaty benefit is claimed (as well as Form 8843, Statement for Exempt Individuals With a Medical Condition).

8. Enter on Form 8843 (If you have changed your visa type of U.S. immigration status, be cautious about applying

treaty benefits properly).

9. This will indicate whether further questioning is needed to determine proper treaty benefits, as well as residency.

10. Keep in mind, a J-type visa can also include certain students, if their primary purpose is for study.

11

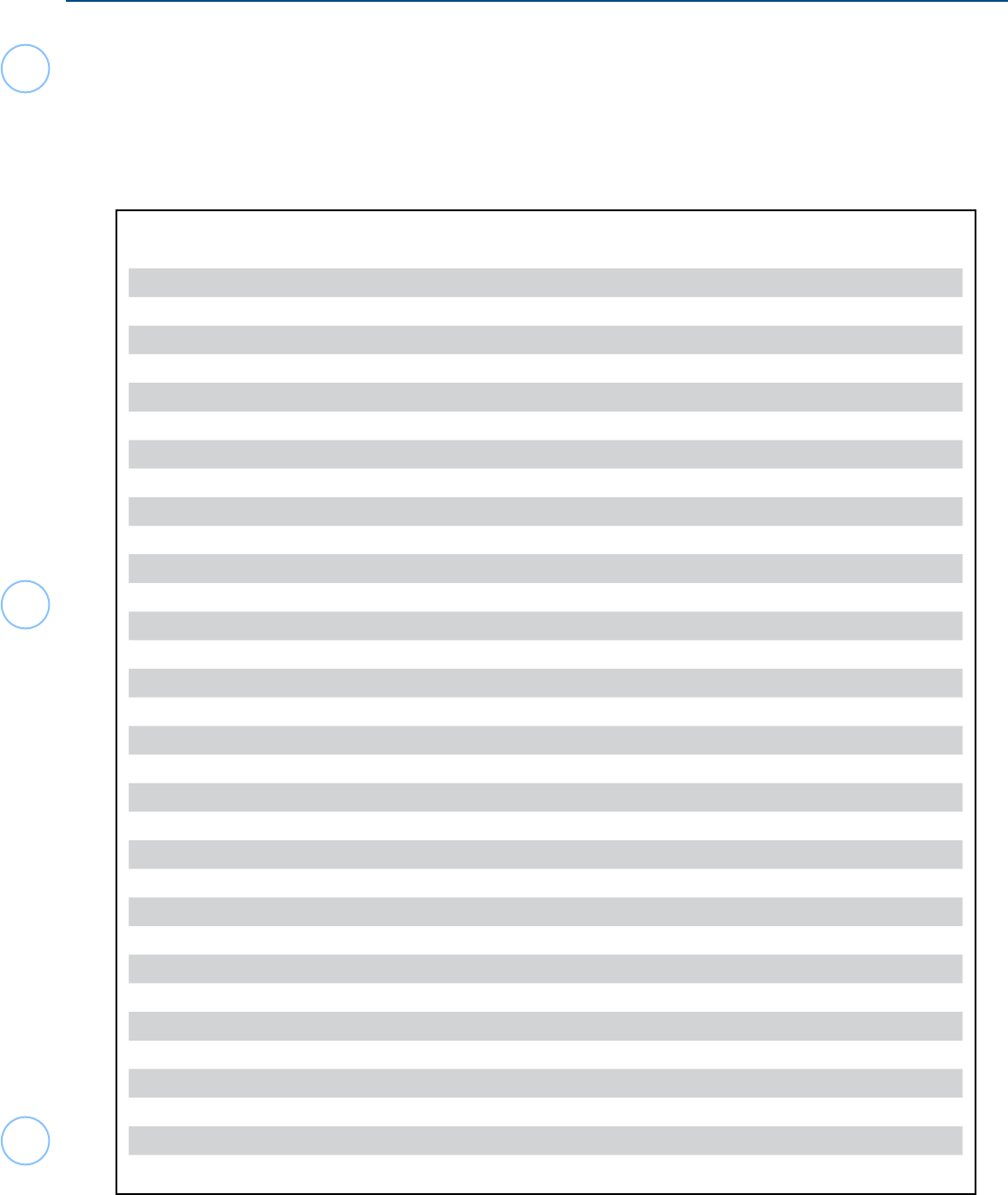

Form 13614-NR - Common Issues, Page 2

Catalog Number 39748B www.irs.gov

Form

13614-NR (Rev. 5-2023)

Check the years you were present in the United States as a teacher, trainee, student or as an accompanying spouse or

dependent of a person in such status for any part of the year.

2017 2018 2019 2020 2021 2022

Have you ever been present in the U.S. PRIOR to 2017 on a teacher, trainee, student visa, or as their accompanying spouse or

dependent?

Yes No

If so, what years and visa type

How many days (including vacations, nonworkdays and partial days) were you present in the U.S. during

2021 2022 2023

List the dates you entered and left the United States during 2023

Date entered United States

mm/dd/yyyy

Date departed United States

mm/dd/yyyy

Date entered United States

mm/dd/yyyy

Date departed United States

mm/dd/yyyy

Did you file a U.S. income tax return for any year before 2023? Yes No

If “Yes”, give latest year

/ /

Form number filed

During 2023, did you apply to be a green card holder (lawful permanent resident) of the United States? Yes No

Do you have an application pending to change your status to lawful permanent resident? Yes No

1. Are you claiming the benefits of a U.S. income tax treaty with a foreign country?

Yes No

If “Yes”, enter the appropriate information in the columns below

(a) Country (b) Tax treaty article

(c) Number of months

claimed in prior tax years

(d) Amount of exempt

income in current tax year

2. Were you subject to tax in a foreign country on any of the income shown in 1(d) above? Yes No

Information about academic institution you attended in 2023

Name Telephone number

Address

Name of your academic/specialized program director

Address

Telephone number

During 2023 did you receive

Scholarships or fellowship grants Yes No

Wages, salaries or tips Yes No

Interest Yes No

Distributions from IRA, pension or annuity

Yes No

State or local tax refunds Yes No

Unemployment compensation Yes No

Dividend income or capital gains or losses Yes No

Any other income (gambling, lottery, prizes, awards, self-employment, rents, royalties, virtual currency, etc.) Yes No

Did you have

Casualty losses in a declared disaster

area

Yes No

Student loan interest paid Yes No

State or local income taxes Yes No

U.S. Charitable contributions Yes No

Child/Dependent care expenses Yes No

IRA contributions Yes No

Did you or any dependent have health insurance coverage through HealthCare.gov (The Marketplace)?

NoYesIf yes, was any Advanced Premium Tax Credit received? (Provide Form 1095-A)

Yes No

Privacy Act and Paperwork Reduction Act Notice

The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We

must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a benefit, or mandatory.

Our legal right to ask for information is 5 U.S.C. 301. We are asking for this information to assist us in contacting you relative to your interest and/or participation in the IRS

volunteer income tax preparation and outreach programs. The information you provide may be furnished to others who coordinate activities and staffing at volunteer return

preparation sites or outreach activities. The information may also be used to establish effective controls, send correspondence and recognize volunteers. Your response is

voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs.

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-2075.

Also, if you have any comments regarding the time estimates associated with this study or suggestion on making this process simpler, please write to the Internal Revenue

Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

11

12

13

14

15

16

17

18

11. For use in determining exempt days status. (Students may exempt only 5 years TOTAL)

12. Partial days count as full days, unless a Canadian or Mexican commuter with +75% workdays commuting.

(Entered on Form 8843 in TaxSlayer)

13. Most tax years end 12/31/XXXX. List Form 1040, 1040-NR etc., as appropriate.

14. Most treaty articles are listed under income codes 16, 19 or 20 later in this publication. Enter these on Schedule OI.

15. If more than one academic institution was attended during the tax year, use the most recent prior to 01/01/2023.

This information will be used on Form 8843 in TaxSlayer.

16. The school or other payer may provide information for scholarships, grants, wages and salaries electronically and/

or paper form with various formats. Inquire about all sources of income and deductions in this section.

17. Advise taxpayer of record requirements for charitable contributions.

18. Caution: While most student/scholars have insurance provided through their sponsoring school, organization, etc.,

some may have applied for coverage through the Marketplace and erroneously received a Premium Tax Credit that

needs to be repaid.

12

Unique Treaty Provisions

United States-India Income Tax Treaty, Article 21(2)

An Indian student or apprentice may take a standard deduction equal to the amount allowable on Form

1040 and may be able to claim the personal exemptions for a nonworking spouse and U.S. born-children.

However, benefits will be limited to certain credits, as the allowable exemption deduction is currently -0- until

2025.

Treaty benefits for a scholar from India are very different from those for a student. The scholar benefit for

income code 19 is lost retroactively if the visit exceeds 2 years.

Generally, the standard deduction for Single taxpayers and Married Filing Separately taxpayers in 2023 is

$13,850.

Nonresident aliens can’t file a joint return. Even though a student from India may be able to take an

exemption for a nonworking spouse, this is not considered a joint return. Thus, the standard deduction for

married filing separately must be used. In determining their tax liability, they must use the tax tables or tax

rate schedules for married filing separately.

United States-People’s Republic of China Treaty, Articles 19, 20(c)

Almost all U.S. tax treaties are limited to a specific number of years and may not be available for U.S.

residents for tax purposes. An exception is the United States-People’s Republic of China Treaty. Its

provisions are not limited by year restrictions.

Also: This treaty is not applicable to Chinese citizens who are residents of Hong Kong, Macao, or Taiwan.

The United States-People’s Republic of China Treaty provides that a scholar is exempt from tax on earned

income for 3 years. After 2 years, a scholar will become a resident alien for tax purposes but is still entitled

to 1 more year of tax benefits under the treaty. The treaty also provides that students have an exemption of

up to $5,000 per year for income earned while they are studying or training. In most cases, the student will

become a resident for federal tax purposes in their sixth calendar year. Students from the People’s Republic

of China can continue to claim the treaty benefits on their resident alien tax return (if they still meet the

definition of a student).

United States-Canada Income Tax Treaty, Article 15

The students and scholars are permitted to use Article 15 of the tax treaty, which applies to dependent

personal services.

Students and scholars making use of the treaty benefits for dependent and independent personal service

income (Income Codes 17 and 18) remain Out of Scope for the VITA/TCE Foreign Student and Scholar

Program and must be referred to a professional tax preparer.

The tax treaty with Canada is different from most other tax treaties because it (1) exempts all earned income

if the nonresident earned not more than $10,000 in the tax year, but (2) taxes all income if the nonresident

earned more than $10,000. This treaty benefit is lost if the nonresident becomes a resident for tax purposes.

13

* Commonwealth of Independent States (Armenia, Azerbaijan, Belarus, Georgia, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan

and Uzbekistan.) Generally, limited to $10,000 p.a. of scholarship/fellowship income to provide ordinary living expenses.

Country

Maximum

Years in U.S.

Maximum

Dollar Amounts

Treaty

Article

Bangladesh 2 No Limit 21(2)

China, People’s Republic of No Limit No Limit 20(b)

Commonwealth of Independent States* 5 Limited VI(1)

Cyprus 5 No Limit 21(1)

Czech Republic 5 No Limit 21(1)

Egypt 5 No Limit 23(1)

Estonia 5 No Limit 20(1)

France 5 No Limit 21(1)

Germany No Limit No Limit 20(3)

Iceland 5 No Limit 19(1)

Indonesia 5 No Limit 19(1)

Israel 5 No Limit 24(1)

Kazakhstan 5 No Limit 19

Korea, South 5 No Limit 21(1)

Latvia 5 No Limit 20(1)

Lithuania 5 No Limit 20(1)

Morocco 5 No Limit 18

Netherlands 3 No Limit 22(2)

Norway 5 No Limit 16(1)

Philippines 5 No Limit 22(1)

Poland 5 No Limit 18(1)

Portugal 5 No Limit 23(1)

Romania 5 No Limit 20(1)

Russia 5 No Limit 18

Slovak Republic 5 No Limit 21(1)

Slovenia 5 No Limit 20(1)

Spain 5 No Limit 22(1)

Thailand 5 No Limit 22(1)

Trinidad and Tobago 5 No Limit 19(1)

Tunisia 5 No Limit 20

Ukraine 5 No Limit 20

Venezuela 5 No Limit 21(1)

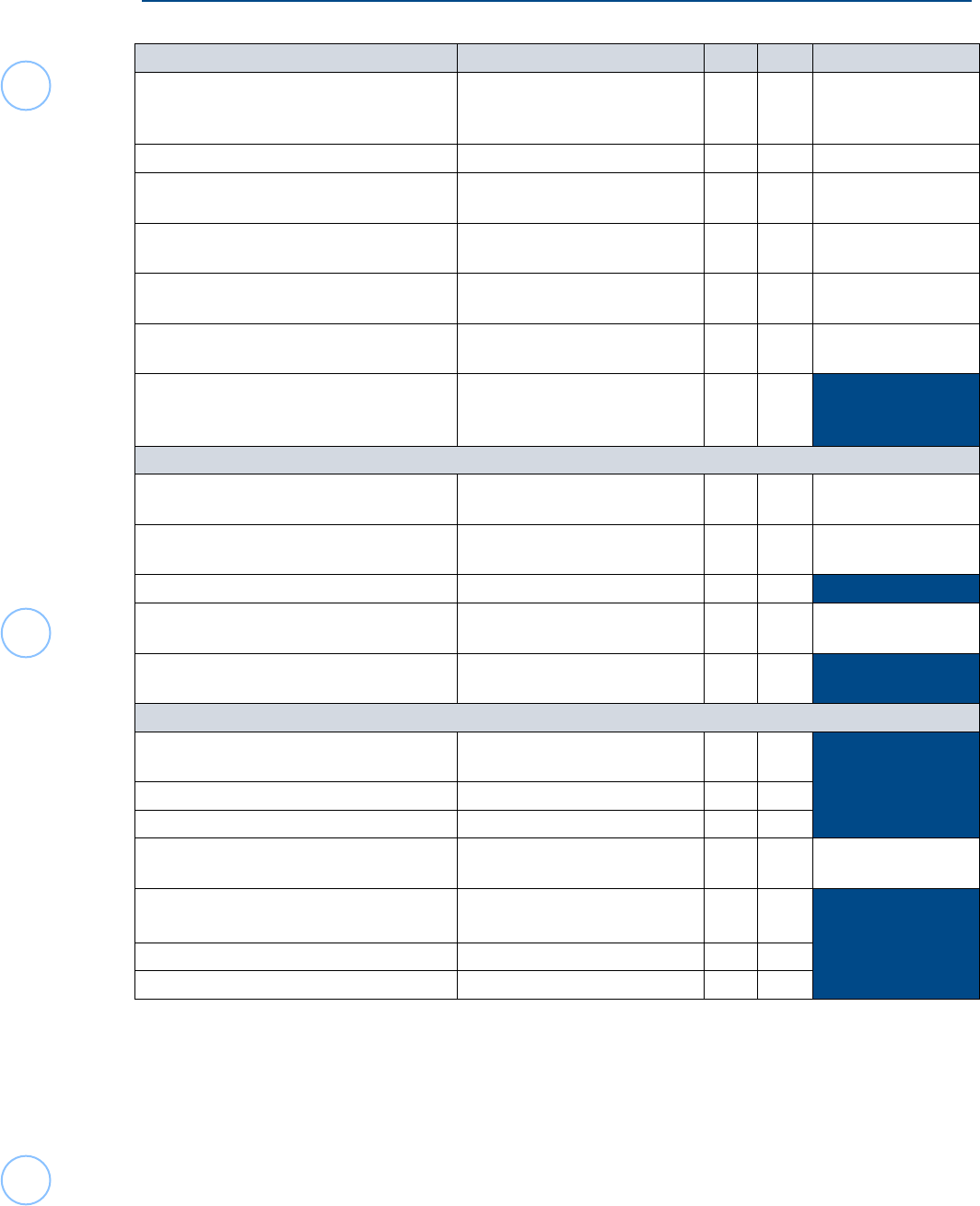

Countries with Treaty Benefits for Scholarship or Fellowship Grants

(Income Code 16)

If a nonresident alien receives a grant that is not from U.S. sources, it is not subject to U.S. tax.

Scholarship or fellowship grants that cover tuition and fees (and books and supplies if required of all

students) are not subject to U.S. tax. (Financial aid that is dependent on the performance of services,

such

as a teaching assistant, is treated as wages and subject to the code income 18, 19, or 20 provisions.)

Scholarship or fellowship grants that cover room, board and other personal expenses are subject

to U.S. tax unless a treaty benefit (as summarized below) exists.

14

Country

Maximum

Years in U.S.

Maximum

Dollar Amounts

Treaty

Article

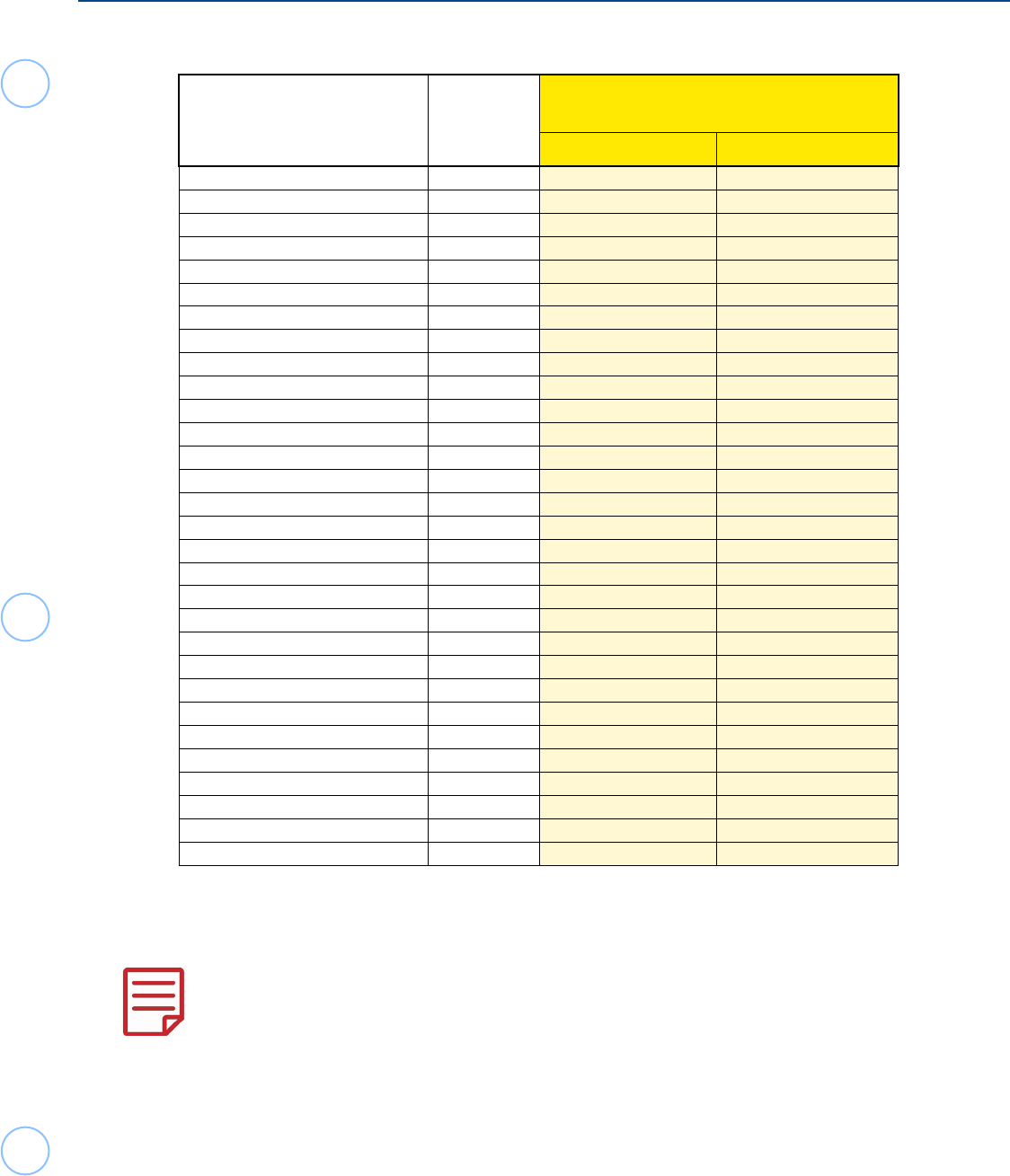

Bangladesh 2 No Limit* 21(1)

Belgium 2 No Limit 19(2)

Bulgaria 2 No Limit 19(2)

China, People’s Republic of 3 No Limit 19

Commonwealth of Independent States** 2 No Limit VI(1)

Czech Republic 2 No Limit 21(5)

Egypt 2 No Limit 22

France 2 No Limit 20

Germany 2 No Limit 20(1)

Greece 3 No Limit XII

Hungary 2 No Limit 17

India 2L No Limit 22

Indonesia 2 No Limit 20

Israel 2 No Limit 23

Italy 2 No Limit 20

Jamaica 2 No Limit 22

Japan 2 No Limit 20

Korea, South 2 No Limit 20

Luxembourg 2L No Limit 21(2)

Netherlands 2L No Limit 21(1)

Norway 2 No Limit 15

Pakistan 2L No Limit XII

Philippines 2 No Limit 21

Poland 2 No Limit 17

Portugal 2 No Limit 22

Romania 2 No Limit 19

Slovak Republic 2 No Limit 21(5)

Slovenia 2 No Limit 20(3)

Thailand 2L No Limit 23

Trinidad and Tobago 2 No Limit 18

Turkey 2 No Limit 20(2)

United Kingdom 2L No Limit 20A

Venezuela 2 No Limit 21(3)

Countries with Treaty Benefits for Teaching and Research

(Income Code 19)

The following is a quick-reference summary of treaty benefits. For more information about the

application of these treaty benefits, see Publication 901.

* 2-year limit applies to business or technical apprentices.

** Commonwealth of Independent States (Armenia, Azerbaijan, Belarus, Georgia, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan

and Uzbekistan.)

L

Treaty contains provisions that retroactively eliminates benefits if the allowable period in the U.S. or income amounts are

exceeded as defined in the treaty.

15

Country

Maximum

Years in U.S.

Maximum

Dollar Amounts

Treaty

Article

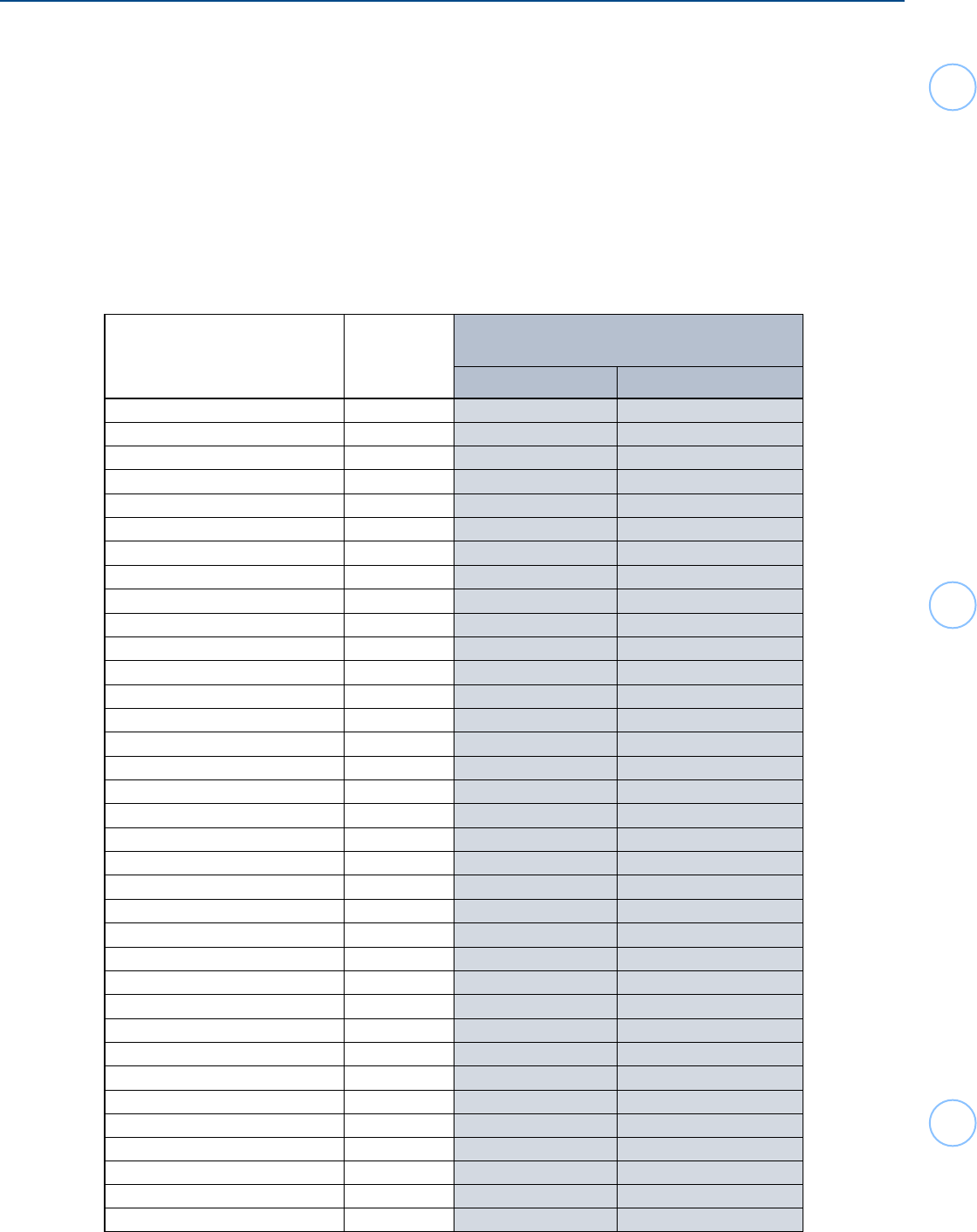

Bangladesh No Limit* $8,000 21(2)

Belgium No Limit 9,000 19(1)(b)

Bulgaria No Limit 9,000 19(1)(b)

China, People’s Republic of No Limit 5,000 20(c)

Cyprus 5 2,000 21(1)

Czech Republic 5 5,000 21(1)

Egypt 5 3,000 23(1)

Estonia 5 5,000 20(1)

France 5 5,000 21(1)

Germany 4L 9,000 20(4)

Iceland 5 9,000 19(1)

Indonesia 5 2,000 19(1)

Israel 5 3,000 24(1)

Korea, South 5 2,000 21(1)

Latvia 5 5,000 20(1)

Lithuania 5 5,000 20(1)

Luxembourg 2L No Limit 21(2)

Malta No Limit 9,000 20(2)

Morocco 5 2,000 18

Netherlands No Limit 2,000 22(1)

Norway 5 2,000 16(1)

Pakistan No Limit 5,000 XIII(1)

Philippines 5 3,000 22(1)

Poland 5 2,000 18(1)

Portugal 5 5,000 23(1)

Romania 5 2,000 20(1)

Slovak Republic 5 5,000 21(1)

Slovenia 5 5,000 20(1)

Spain 5 5,000 22(1)

Thailand 5 3,000 22(1)

Trinidad and Tobago 5 2,000 19(1)

Tunisia 5 4,000 20

Venezuela 5 5,000 21(1)

Countries With Treaty Benefits for Studying and Training (Income Code 20)

The following is a quick-reference summary of treaty benefits. For more information about the

application of these treaty benefits, see Publication 901.

* 2-year limit applies to business or technical apprentices.

L

Treaty contains provisions that retroactively eliminates benefits if the allowable period in the U.S. or income amounts are

exceeded as defined in the treaty.

Tax Treaty provisions allowed federally may not be honored by some states. Contact your

state to see if treaty provisions are honored on the state return.

16

Capital Gains / Losses

The only capital gains/losses within the scope of the Foreign Student & Scholar VITA program are

related to the sale of U.S. stocks, generally considered NOT effectively connected with the taxpayer’s U.S.

trade or business. All other sales of property remain Out of Scope.

If a nonresident alien is physically present in the U.S. for less than 183 days during the tax year, none of

the capital gains from these sales are taxable. The days counted for excludable gains consider all days of

presence, regardless of exempt days based on visa status under IRC §7701(b).

If the nonresident is present in the U.S. for 183 days or more, generally the rate of tax on the gain is 30%.

This income is reported on Form 1040-NR, U.S. Non Resident Alien Income Tax Return, Schedule NEC,

Tax on Income Not Effectively Connected With a U.S. Trade or Business, NOT on Schedule D, Capital

Gains and Losses, nor on the income section of Form 1040-NR. Capital losses of nonresident aliens may

only offset other capital gains. (Capital losses of nonresident aliens cannot be used against other income,

nor can they be carried forward to another tax year.)

Some tax treaties provide an exclusion from tax on various capital gains relating to stock sales. The

following countries have a tax treaty with the U.S. If the table below indicates a potential 0% tax, review all

paragraphs of the treaty article fully to ensure all conditions are met (reported on Schedule NEC). (Some

treaties limit the percentage of stock ownership held or types of assets held by the corporation, etc.)

Tax Treaties Taxation Rate - Capital Gains (from Sales of U.S. Stocks)

Treaty Country

Country

Code

Capital Gains from

U.S. Corporate Stock sales

Rate

Treaty Article Citation

Australia

AS 30% none

Austria AU 0 13(6)

Bangladesh BG 0 13(4)

Barbados BB 0 13(6)

Belgium BE 30% 13(3)

Bulgaria BU 0 13(8)

Canada CA 0 XIII(4)

China, People’s Republic of CH 30% 12

Comm. of Independent States* - 0 IIII(1)(b)

Cyprus CY 0 16(1)

Czech Republic EZ 0 13(6)

Denmark DA 0 13(6)

Egypt EG 30% 14(1)(d)

Estonia EN 0 13(6)

Finland FI 0 13(6)

France FR 0 13(6)

Germany GM 0 13(5)

Greece GR 30% none

Hungry HU 0 12(3)

Iceland IC 0 13(6)

India IN 30% 13

Indonesia ID 30% 14(2)(b)

Ireland EI 0 13(5)

Israel IS 30% 15(1)(d)

Italy IT 0 13(4)

Jamaica JM 0 13(6)

Japan JA 0 13(7)

Kazakhstan KZ 0 13(6)

Korea, South KS 0 13(6)

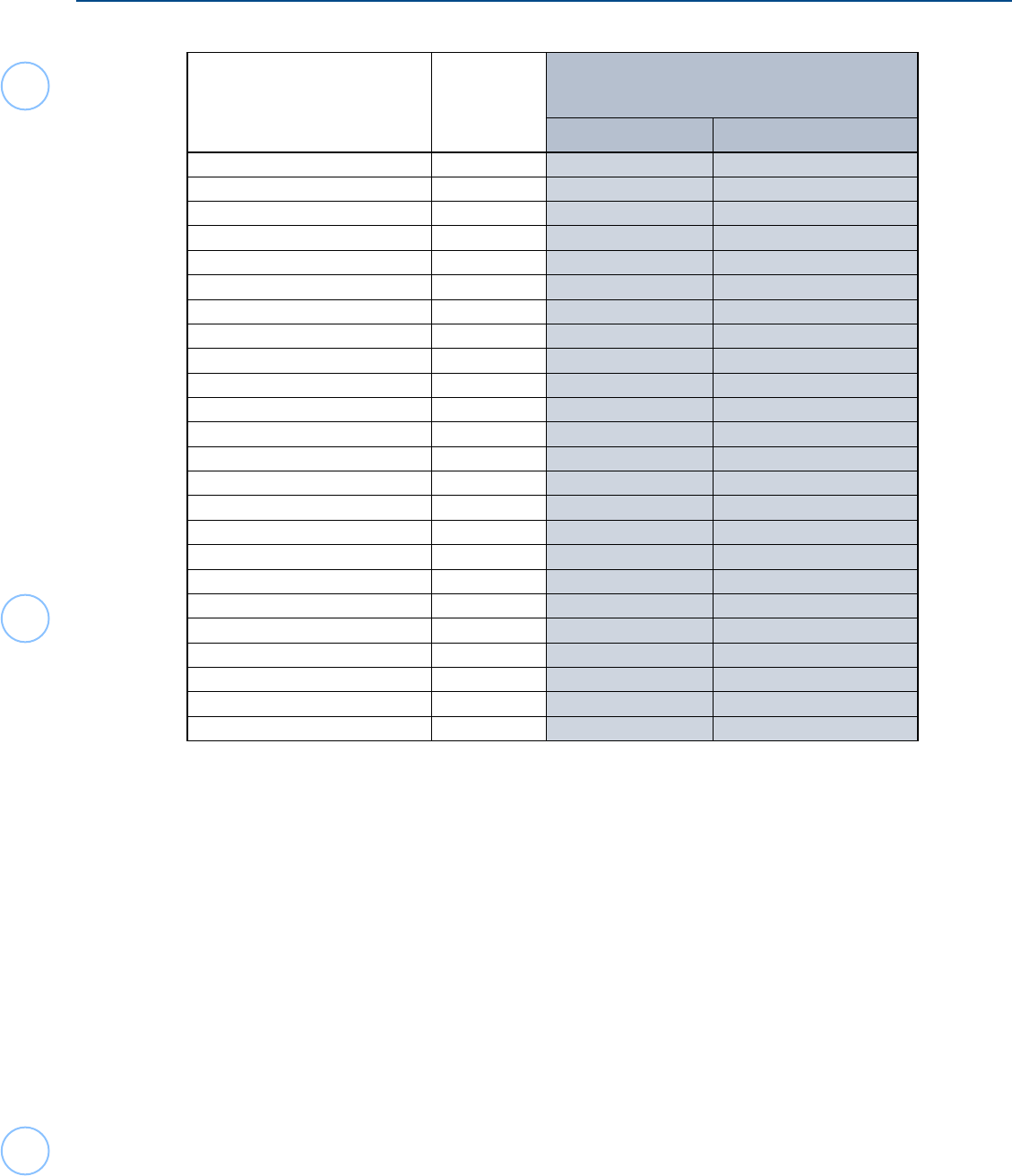

17

Treaty Country

Country

Code

Capital Gains from

U.S. Corporate Stock sales

Rate Treaty Article Citation

Latvia LG 0 13(6)

Lithuania LH 0 13(6)

Luxembourg MT 0 14(5)

Malta MX 0 13(6)

Mexico BE 0 13(7)

Morocco MO 0 13(2)(c)(ii)

Netherlands NL 0 14(7)

New Zealand NZ 0 13(7)

Norway NO 30% 12(1)(c)(ii)

Pakistan PK 30% none

Philippines RP 0 14(2)

Poland PL 0 14(7)

Portugal PO 0 14(6)

Romania RO 30% 13(1)(b)

Russia RS 0 21(4)

Slovak Republic LO 0 13(6)

Slovenia SI 0 13(5)

South Africa SF 0 13(5)

Spain SP 0 13(7)

Sri Lanka CE 0 13(7)

Sweden SW 0 13(6)

Switzerland SZ 0 13(5)

Thailand TH 30% 13

Trinidad & Tobago TD 30% –

Tunisia TS 0 13(5)

Turkey TU 0 13(5)

Ukraine UP 0 13(4)

United Kingdom UK 30% 13

Venezuela VE 0 13(5)

Other Countries – 30% –

* Those countries to which the U.S.-U.S.S.R. income tax treaty still applies: Armenia, Azerbaijan, Belarus,

Georgia, Kyrgyzstan, Moldova, Tajikistan,Turkmenistan, and Uzbekistan.

Nonresident aliens residing in the U.S. for less than 183 days in the tax year, generally

are exempt from tax on Capital gains from U.S. stock sales.

Tax Treaties Taxation Rate - Capital Gains (from Sales of U.S. Stocks)

Capital Gains / Losses

18

Dividend Income

Generally, dividend income from investments in U.S. corporate stock is considered FDAP (Fixed,

Determinable, Annual or Periodic) income, NOT effectively connected to the taxpayer’s U.S. trade or

business and is therefore taxable at a 30% rate on Form 1040-NR, Schedule NEC, NOT on the income

section on the front of Form 1040-NR.

The U.S. has income tax treaties with a number of foreign countries. These treaties can often reduce or

eliminate U.S. income tax on various types of income, such as dividends, if certain conditions are met.

Carefully read the tax treaty article and the conditions allowing for reduced rates. Many of these reduced

rates only apply to regulated investment companies (RICs) or a real estate investment trusts (REITs).

Below is a list of the treaty countries and the treaty article and protocol potentially allowing reduced rates.

Dividend income for the nonresident aliens is subject to 30% income tax rate, unless a lower rate is allowed by

treaty. These lower treaty rates are Out of Scope for the VITA/TCE Foreign Student and Scholar program.

Tax Treaties / Taxation Rate - Dividends (paid by U.S. Corporations)

Treaty Country

Country

Code

Dividends paid by

U.S. Corporations (general)

Rate Treaty Article Citation

Australia AS 15mm 10(2)/P6

Austria AU 15w 10(2)

Bangladesh BG 15mm 10(2)

Barbados BB 15w, rr 10(2)/1PIII(1); 2PII(6)

Belgium BE 15dd, mm 10(2)

Bulgaria BU 10dd, mm 10(2)

Canada CA 15mm X(2)/5P5(1)

China, People’s Republic of CH 10 9(2)

Comm. of Independent States* – 30 None

Cyprus CY 15 12(2)

Czech Republic EZ 15w 10(2)

Denmark DA 15dd, mm 10(2)/PII

Egypt EG 15 11(2)

Estonia EN 15w 10(2)

Finland FI 15dd, mm 10(2)/PIII

France FR 15mm 10(2)/2P2

Germany GM 15dd, mm 10(2)/PIV

Greece GR 30 none

Hungry HU 15 9(2)

Iceland IC 15dd, mm 10(2)

India IN 25w 10(2)

Indonesia ID 15 11(2)/P1

Ireland EI 15mm 10(2)

Israel IS 25w 12(2)

Italy IT 15mm 10(2)

Jamaica JM 15 10(2)/P2

Japan JA 10dd, mm 10(2)

Kazakhstan KZ 15ff 10(2)

Korea, South KS 15 12(2)

Latvia LG 15w 10(2)

Lithuania LH 15w 10(2)

Luxembourg LU 15w 10(2)

Malta MT 15dd, mm 10(2)

Mexico MX 10dd. mm 10(2)/2PII

Morocco MO 15 10(2)

19

Treaty Country Country

Code

Dividends paid by

U.S. Corporations (general)

Rate Treaty Article Citation

Netherlands NL 15dd, mm 10(2)/P3(a)

New Zealand NZ 15mm 10(2)/PVI

Norway NO 15 8(2)/PVI(1)

Pakistan PK 30 VII(2)/VI(1)

Philippines RP 25 11(2)

Poland PL 15 11(2)

Portugal PO 15w 10(2), (3)

Romania RO 10 10(2)

Russia RS 10ff 10(2)

Slovak Republic LO 15w 10(2)

Slovenia SI 15mm 10(2)

South Africa SF 15w 10(2)

Spain SP 15w 10(2)

Sri Lanka CE 15gg 10(2)

Sweden SW 15dd, mm 10(2)/PIV

Switzerland SZ 15w, dd 10(2)

Thailand TH 15w 10(2)

Trinidad & Tobago TD 30 12(1)

Tunisia TS 20w 10(2)

Turkey TU 20w 10(2)

Ukraine UP 15ff 10(2)

United Kingdom UK 15mm 10(2)

Venezuela VE 15mm 10(2)

Other Countries – 30 None

* Those countries to which the U.S.-U.S.S.R. income tax treaty still applies: Armenia, Azerbaijan, Belaru

Georgia, Kyrgyzstan, Moldova, Tajikistan,Turkmenistan, & Uzbekistan.

w

The rate applies to dividends paid by a regulated investment company (RIC) or a real estate investment trust

(REIT). However, that rate applies to dividends paid by a REIT only if the beneficial owner of the dividends is

an individual holding less than a 10% interest (25% in the case of Portugal, Spain, Thailand, and Tunisia) in

the REIT.

dd

Amounts paid to certain pension funds that are not derived from the carrying on of a business, directly or indi-

rectly, by the fund are exempt. This includes dividends paid by a REIT only if the conditions in footnote mm

are met. For Sweden, to be entitled to the exemption, the pension fund must not sell or make a contract to

sell the holding from which the dividend is derived within 2 months of the date the pension fund acquired the

holding. The United States has competent authority arrangements (MAP) with some treaty jurisdictions (e.g.

Netherlands and Switzerland) that describe which pension funds are eligible for the exemption. See the Com

petent Authority Arrangements page on irs.gov.

ff

The rate applies to dividends paid by a regulated investment company (RIC). Dividends paid by a real estate

investment trust (REIT) are subject to a 30% rate.

gg

In Sri Lanka, the rate applies to dividends paid by a real estate investment trust (REIT) only if the beneficial

owner of the dividends is (a)an individual holding less than a 10% interest in the REIT, (b) a person holding not

more than 5% of any class of the REIT’s stock and the dividends are paid on stock that is publicly traded, or

(c) a person holding not more than a 10% interest in the REIT and the REIT is diversified.

mm

The rate applies to dividends paid by a regulated investment company (RIC) or real estate investment trust

(REIT). However, that rate applies to dividends paid by a REIT only if the beneficial owner of the dividends is

(a) an individual (or pension fund, in some cases) holding not more than a 10% interest in the REIT, (b) a

person holding not more than 5% of any class of the REIT’s stock and the dividends are paid on stock that is

publicly traded, or (c) a person holding not more than a 10% interest in the REIT and the REIT is diversified.

Dividend Income

Tax Treaties / Taxation Rate - Dividends (paid by U.S. Corporations)

20

pp

The rate applies to dividends paid by a regulated investment company (RIC) or real estate investment trust

(REIT). However, that rate applies to dividends paid by a REIT only if the beneficial owner of the dividends is

(a) an individual holding not more than a 25% interest in the REIT, (b) a person holding not more than 5% of

any class of the REIT’s stock and the dividends are paid on stock that is publicly traded, or (c) a person hold-

ing not more than a 10% interest in the REIT and the REIT is diversified, or (d) a Dutch belegginginstelling.

rr

The rate applies to dividends paid by a regulated investment company (RIC) or a real estate investment trust

(REIT). However, that rate applies to dividends paid by a REIT only if the beneficial owner of the dividends is

an individual holding less than a 10% interest (25% in the case of Portugal, Spain, Thailand, and Tunisia) in

the REIT.

State Income Tax Refunds

If the taxpayer itemized in 2022 that included a deduction for state income tax, and received a state refund in

2023, that refund may be included as income on the 2023 tax return.

Students may have received taxable refunds of state and/or local taxes. Remember that nonresident

students, except from India, must itemize their deductions. This can include state and local income taxes

paid. Any refund of state and local taxes may need to be included on the return in the year received.

Students from India are allowed a standard deduction. If the standard deduction was used on the previous

year’s tax return, do not include the amount of any state or local tax refund in taxable income.

21

How to Claim Treaty Benefits on Form 1040-NR

Nonresident aliens may claim treaty benefits on Form 1040-NR.

If a taxpayer is a resident alien eligible to claim treaty benefits on Form 1040, the return is Out of

Scope for the VITA/TCE Foreign Student and Scholar program.

The following shows how to claim treaty benefits listed on Form 1042-S, Foreign Person’s U.S. Source

Income Subject to Withholding.

First, enter the necessary information based on the F13614-NR, Nonresident Alien Intake and Interview

Sheet entries, and your interview with the taxpayer for the three sections of Schedule OI in TaxSlayer.

This section shows how to enter the Form 1042-S, however, a taxpayer who received a Form W-2,

Wage and Tax Statement, or other income statement may also be eligible to exclude income under

their treaty. This section of the software would be used for these taxpayers, as well.

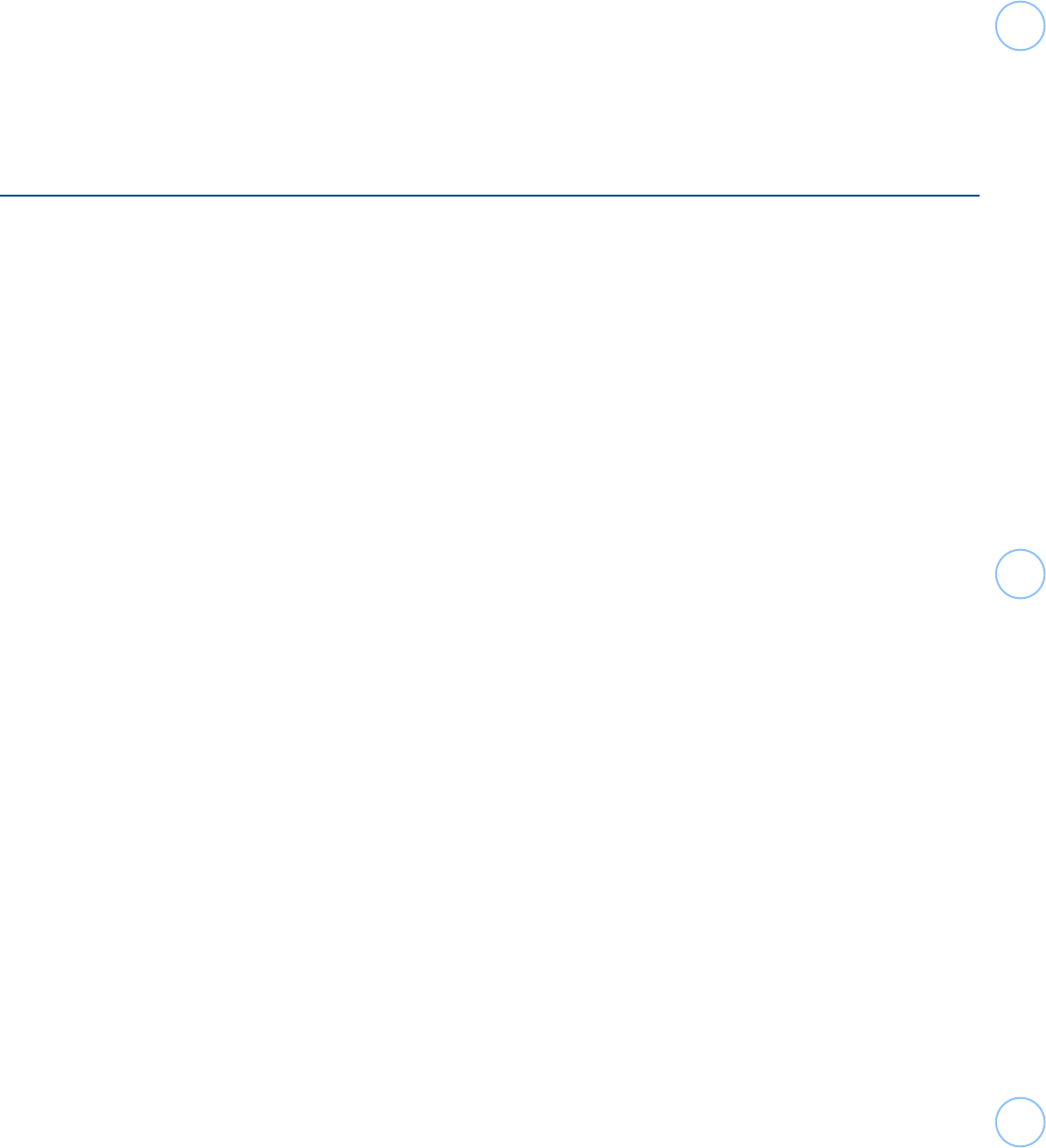

The Schedule OI menu will

automatically open after entering

Dependents / Qualifying Person

selections in the software.

Complete all sections on the Schedule

OI Menu; General Information, Dates

Entered and Departed the U.S. in

Current Year, and Income Exempt from

Tax.

For a taxpayer who does not receive

Form 1042-S and is entitled to claim

treaty benets rst complete the

Schedule OI-General Information with

the allowable treaty benet amount

listed under Wages Exempt by a treaty.

Next, move to Schedule OI- Income

Exempt from Tax and re-enter the

amount of exempt income.

22

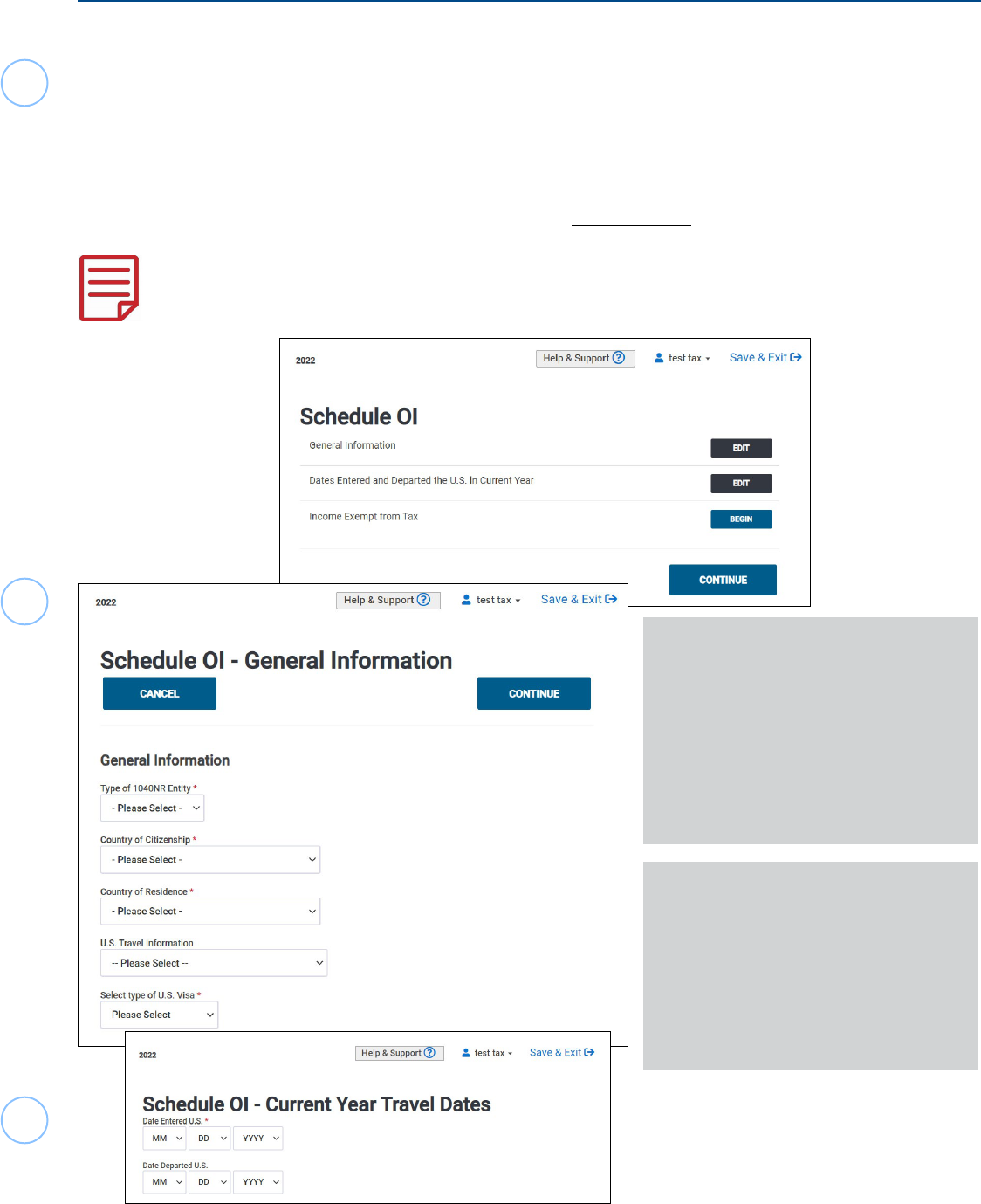

Schedule OI - Income Exempt from Tax

List the country from which the taxpayer

is claiming treaty benets. Once entered,

another box will appear with a drop-down

menu asking which treaty article is being

applied.

If this treaty benet has been used on

PRIOR returns, list the total number of

months the article has been used in

PRIOR years.

List the amount of income THIS year that is

to be exempt from taxation due to the treaty

article. (Remember, if the amount received

is less than the amount excludable by treaty,

list the amount received.)

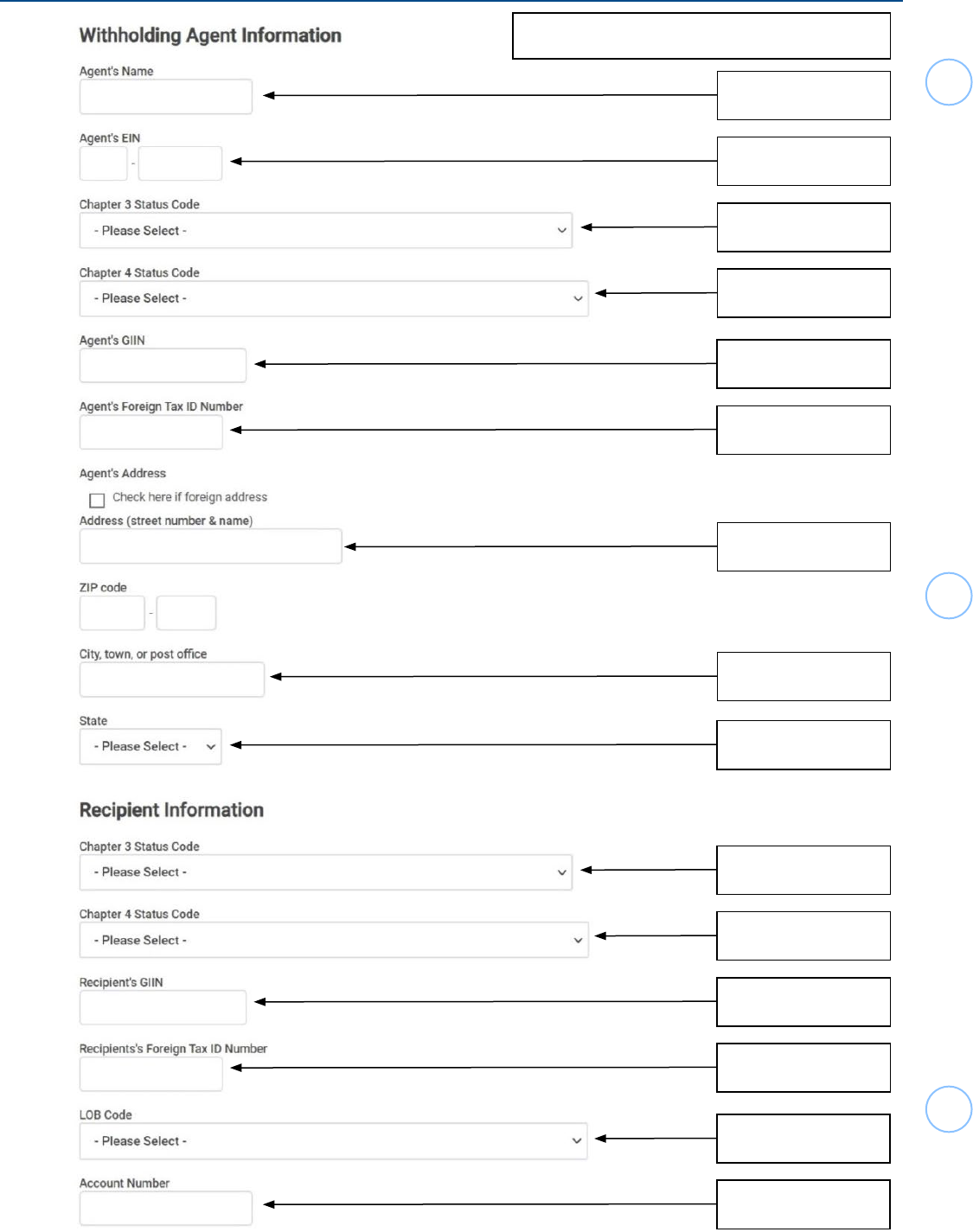

Federal Section>Payments and Estimates>Foreign Person’s U.S. Source Income Subject

to Withholding

1.

Next, you will enter the information

from each box on the Form 1042-S into

the software.

Only enter information for completed

boxes. Each entry has the same

corresponding title as listed on the form

.

1

23

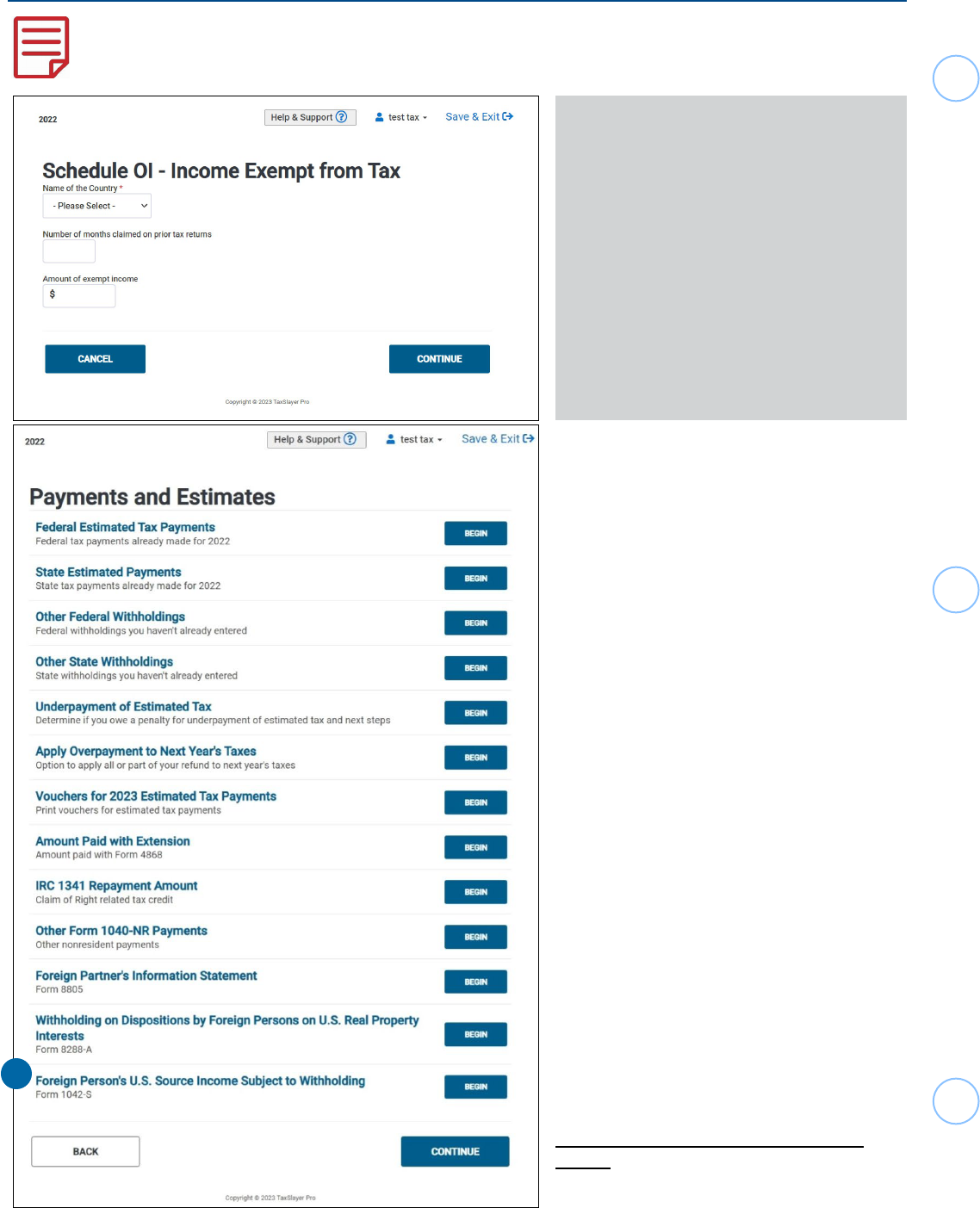

Form 1042-S Foreign Person’s U.S. Income Subject to Withholding

Box 3

Box 3b or 4b rate,

if listed

Listed above Box

3

Generally, Out-of-Scope.

(Amended Returns are

permitted for current year and

special circumstances based

on the site’s established

procedures.)

Box 1

Box 10

Corresponding Box from Form 1042-S

24

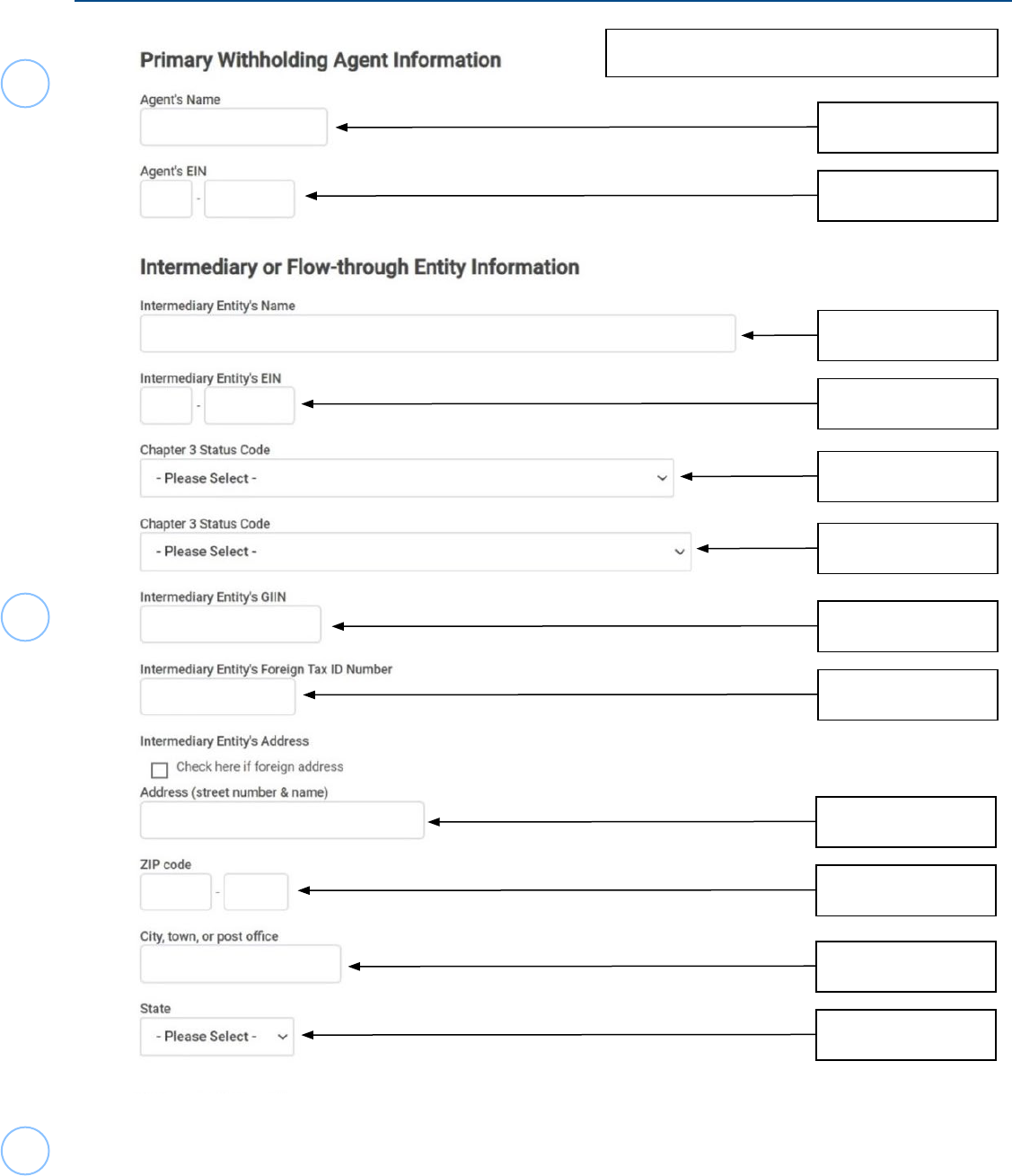

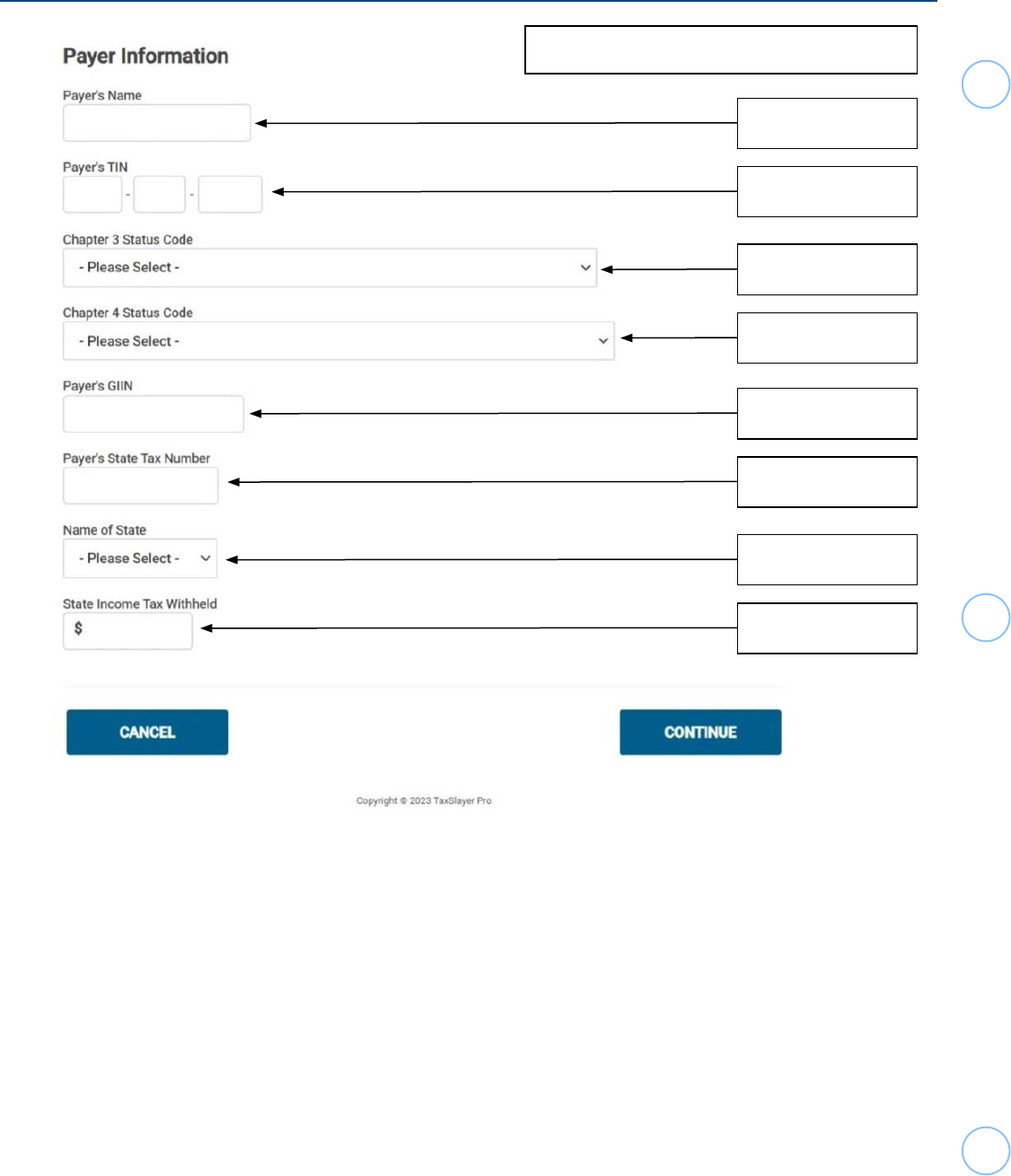

Form 1042-S Foreign Person’s U.S. Income Subject to Withholding

Box 12d

Box 12a

Box 12b

Box 12c

Box 12e

Box 12g

Box 12h

Box 12i

Box 12i

Corresponding Box from Form 1042-S

Box 13f

Box 13g

Box 13h

Box 13i

Box 13j

Box 13k

25

Form 1042-S Foreign Person’s U.S. Income Subject to Withholding

Box 14a

Box 14b

Corresponding Box from Form 1042-S

Box 15d

Box 15a

Box 15b

Box 15c

Box 15e

Box 15g

Box 15h

Box 15i

Box 15i

Box 15i

26

Form 1042-S Foreign Person’s U.S. Income Subject to Withholding

Box 16a

Box 16b

Box 16d

Box 16e

Corresponding Box from Form 1042-S

Box 16c

Box 17b

Box 17c

Box 17a

27

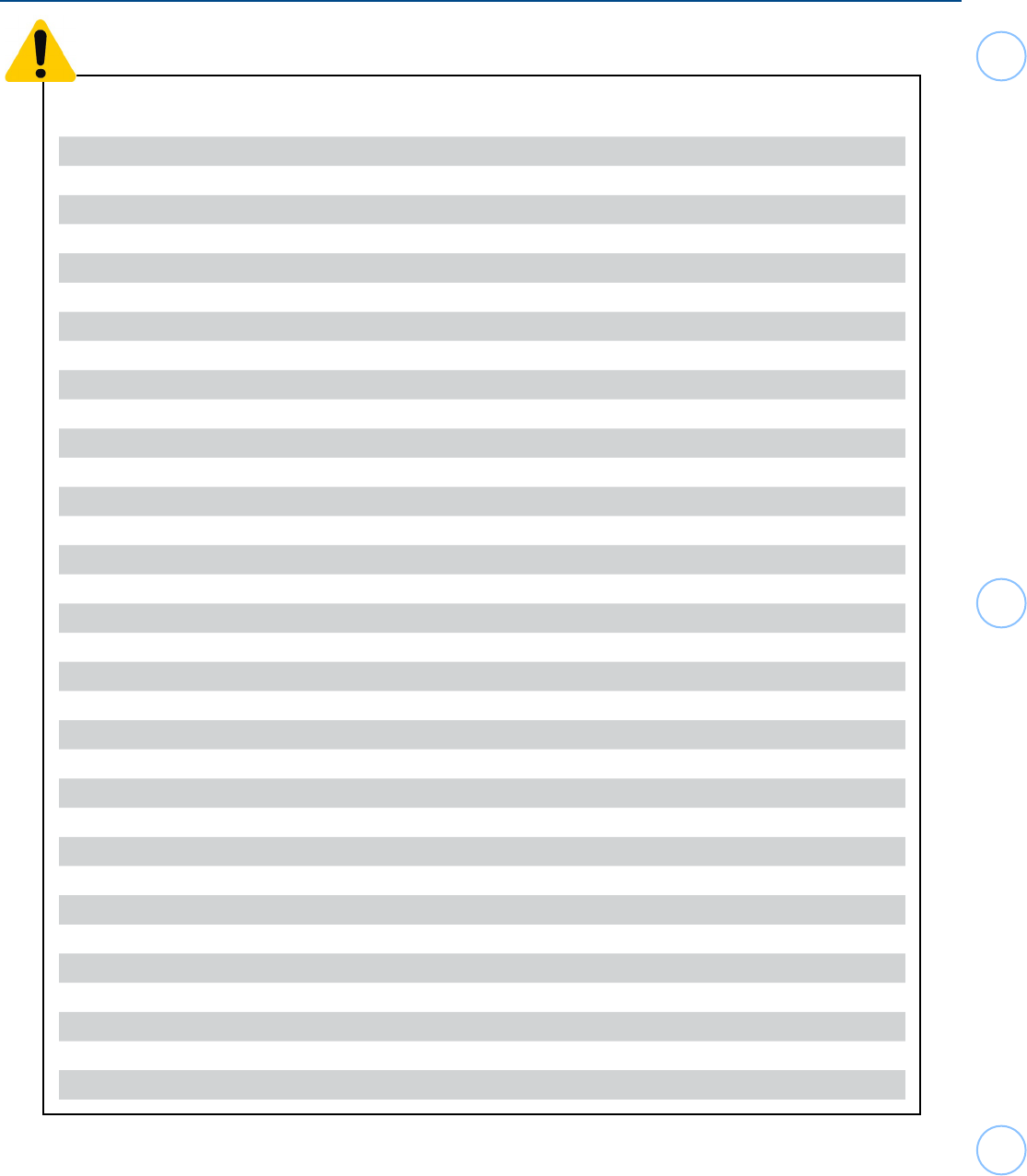

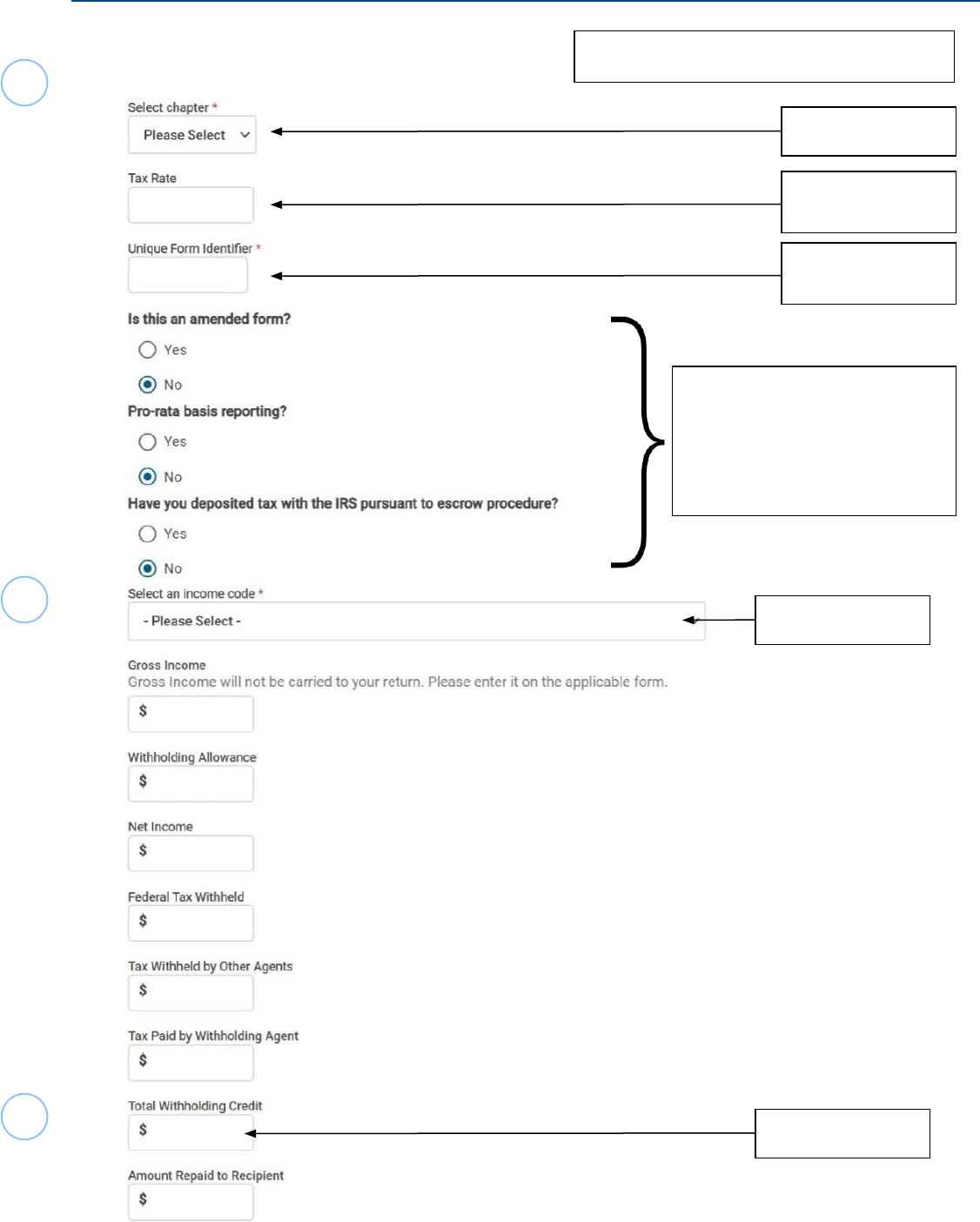

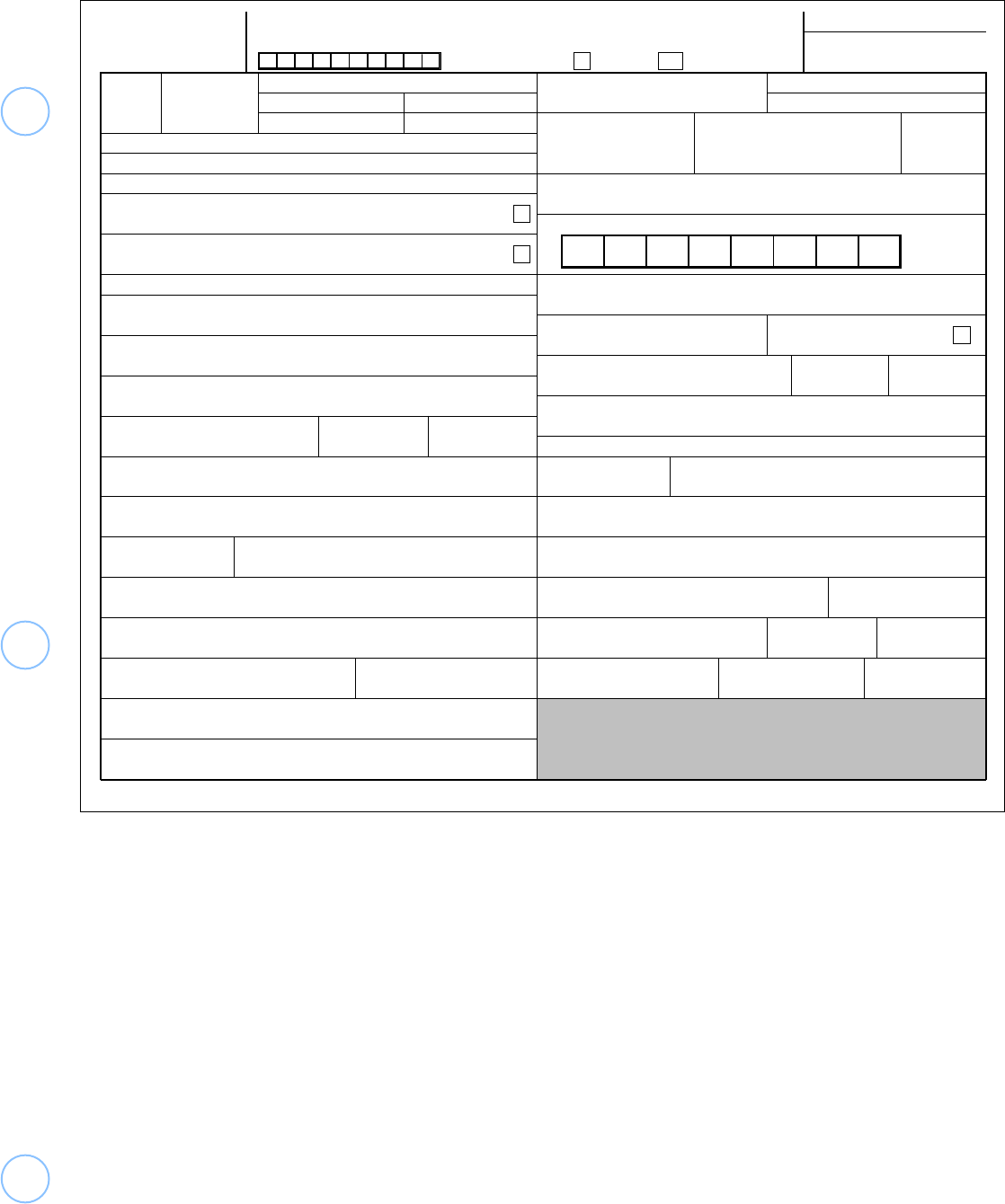

Form 1042-S

Department of the Treasury

Internal Revenue Service

Foreign Person’s U.S. Source Income Subject to Withholding

Go to www.irs.gov/Form1042S for instructions and the latest information.

2023

UNIQUE FORM IDENTIFIER

AMENDED

AMENDMENT NO.

OMB No. 1545-0096

Copy A for

Internal Revenue Service

1 Income

code

2 Gross income

3 Chapter indicator. Enter “3” or “4”

3a Exemption code

3b Tax rate .

4a

Exemption code

4b Tax rate .

5 Withholding allowance

6 Net income

7a Federal tax withheld

7b Check if federal tax withheld was not deposited with the IRS because

escrow procedures were applied (see instructions) . . . . . .

7c Check if withholding occurred in subsequent year with respect to a

partnership interest . . . . . . . . . . . . . .

8 Tax withheld by other agents

9

Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( )

10 Total withholding credit (combine boxes 7a, 8, and 9)

11 Tax paid by withholding agent (amounts not withheld) (see instructions)

12a Withholding agent

’

s EIN

12b

Ch. 3 status code

12c

Ch. 4 status code

12d Withholding agent

’

s name

12e Withholding agent

’

s Global Intermediary Identification Number (GIIN)

12f Country code 12g Foreign tax identification number, if any

12h Address (number and street)

12i City or town, state or province, country, ZIP or foreign postal code

13a Recipient

’

s name 13b Recipient

’

s country code

13c

Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

13e Recipient’s U.S. TIN, if any

13f Ch. 3 status code

13g Ch. 4 status code

13h Recipient’s GIIN

13i

Recipient

’

s

foreign tax identification

number, if any

13j

LOB code

13k Recipient

’

s account number

13l Recipient

’

s date of birth (YYYYMMDD)

14a

Primary Withholding Agent

’

s

Name (if applicable)

14b Primary Withholding Agent

’

s EIN

15 Check if pro-rata basis reporting

15a

Intermediary or flow-through entity’s EIN, if any

15b

Ch. 3 status code

15c

Ch. 4 status code

15d

Intermediary or flow-through entity’s name

15e

Intermediary or flow-through entity’s GIIN

15f Country code 15g Foreign tax identification number, if any

15h Address (number and street)

15i City or town, state or province, country, ZIP or foreign postal code

16a Payer

’

s name 16b Payer

’

s TIN

16c Payer

’

s GIIN

16d

Ch. 3 status code

16e

Ch. 4 status code

17a State income tax withheld 17b Payer

’

s state tax no. 17c Name of state

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 11386R

Form 1042-S (2023)

28

Filing Status

Generally, nonresident aliens must use either the Single or the Married Filing Separately (Married

Nonresident Alien) filing status. (Only residents of Canada, Mexico, Republic of Korea (S. Korea), and

India may qualify for the Qualifying Surviving Spouse, if applicable.) The married nonresident alien status

can be used whether their spouse is present in the U.S. or not.

Head of household filing status cannot be used if the taxpayer was a nonresident alien during any part

of a year.

Nonresidents who are married to U.S. Citizens or resident aliens can make an election to file a joint return

for tax purposes on Form 1040 and file as Married Filing Jointly. (Preparation of the required attached

statement outlined in Publication 519 is Out of Scope.) If both married taxpayers are nonresident aliens,

they CANNOT file as Married Filing Jointly, they must file as Married Filing Separately.

STATE RETURNS: Check with the state income tax authorities regarding the correct filing status that

applies to any state return being prepared.

Exemption Personal/Dependent Issues

The personal and/or dependency exemption deduction for 2023 is $0 through 2025.

Nonresidents from the following countries may be able to claim their children as dependents. Everyone

claimed on the return must have either a Social Security number (SSN) or a valid Individual Taxpayer

Identification Number (ITIN).

Canada Mexico India South Korea

The exemption amount for 2023 is $0. For India and South Korea, refer to Publication 519 for additional

information..

Standard or Itemized Deduction

Standard Deduction - Nonresident aliens are generally not eligible for the standard deduction. For those

eligible (India Treaty), they must use the amount for the single or married filing separately filing status

being used (if legally blind, or over 65, see Publication 501).

Generally, the standard deduction amount for single or married filing separately for 2023 is $13,850.

Itemized Deductions - The Tax Reform Act of 2017 limits the dollar amount of state and local income

taxes that are allowable to $10,000. Miscellaneous Itemized deductions for employee business expenses,

tax preparation fees, etc. have been eliminated. Casualty Losses are now only permitted for Presidentially

Declared Disaster areas (and remain Out of Scope).

The amount you can deduct for contributions made to U.S. qualified charitable organizations is generally

limited to no more than 60% of your AGI. Your deduction may be further limited to 50%, 30%, or 20% of

your AGI, depending on the type of property you give and the type of organization you give it to. Refer to

the Instructions for Form 1040-NR for more information. All other allowable itemized deductions on Form

1040-NR remain unchanged.

29

Wage Calculation Worksheet

Since some employers do not issue the correct reporting documents to international students and

scholars, the following formula will help you to accurately compute the amount of wages to

be shown on

the income tax return.

Wages from Form W-2, box 1 (if any)

Add: Code 19 or 20 income from Form,

1042-S, box 2 (if any) +

To t a l

W-2 and 1042-S

Subtract: Code 19 or 20 treaty benefit

Equals: Wages to be reported on

-

Form 1040-NR, line 8 =

Tax Credits and Nonresident Aliens

Tax credits are allowed to nonresident aliens only if they receive effectively connected income. Generally,

nonresident alien students and scholars will not qualify for tax credits.

Nonresident aliens cannot elect to be treated as resident aliens in order to claim these credits.

(See exception for Married Filing Jointly in the Filing Status section of this publication, and certain

treaty provisions for students from Barbados, Hungary, and Jamaica, as well as trainees from

Jamaica. These exception elections and treaty provisions are both Out of Scope.)

Child Tax Credit — Nonresident aliens may be able to claim the child tax credit if all of the following

conditions are met:

• The child is a U.S. citizen, national, or resident alien who resides with the taxpayer, and

• The child is a son, daughter, adopted child, grandchild, stepchild, or foster child, and

• The child was under age 17 at the end of the year, and

• The child qualifies as their dependent.

• The child MUST have a valid Social Security number

Child and Dependent Care Credit — Nonresident aliens may be able to claim the Child and Dependent

Care Credit if all of the following conditions are met:

• Pay a qualifying caregiver to care for a dependent under the age of 13, or a disabled dependent (any age), or

a disabled spouse, so the taxpayer and spouse (if applicable) can work or look for work.

• Pay for care provided during the hours when a student or scholar was working (or looking for work) rather

than attending classes or studying.

• Not claim an expense for the credit in an amount exceeding earned income from the United States.

• Generally, married persons must file a joint return to claim the credit. If your filing status is married filing

separately and all of the following apply, you are considered unmarried for purposes of claiming the credit

on Form 2441.

You lived apart from your spouse during the last 6 months of tax year.

Your home was the qualifying person’s main home for more than half of the tax year.

You paid more than half of the cost of keeping up that home for the tax year.

Credit for Other Dependents — If the taxpayer has a qualifying dependent who does not meet some of

the requirements for the Child Tax Credit, they may qualify for the Credit for Other Dependents. The child

must reside in the U.S. with the taxpayer and have a valid SSN or ITIN. (See Publication 17, Your Federal

Income Tax (For Individuals) for details.)

Earned Income Credit — If the taxpayer is a nonresident for any part of the year, the earned income

credit is not available.

Education Credits — If the taxpayer is a nonresident alien for any part of the year, they generally can’t

claim the educational credits, such as the American Opportunity Credit and Lifetime Learning Credit.

30

Foreign Tax Credit — This credit will usually not be available to nonresident alien students and scholars.

Their foreign-source income is usually not reported on their U.S. income tax return.

Advanced Premium Tax Credit — (As with many other credits, married taxpayers filing separately do

NOT qualify for the Premium Tax Credit.) If the taxpayer obtained insurance through the Marketplace

and received an Advanced Premium Tax Credit (listed on Form 1095-A, Health Insurance Marketplace

Statement), this must be reported. The following instructions should be followed to report the credit and, if

necessary, repay it:

1.

In TaxSlayer’s Health Insurance section, answer “Yes” to having received a Form 1095-A,

and “Yes” to “Are

you required to repay all of the APTC?” This will cause the software to add the repayment required into the

tax liability.

2. Complete and attach Form 8962, Premium Tax Credit (PTC), to calculate the repayment amount.

Social Security and Medicare Taxes

Generally, a nonresident alien temporarily admitted in the United States as a student is not permitted to work

for a wage or salary or to engage in business while in the United States. However, if a student is granted

permission to work, Social Security and Medicare taxes are not withheld from their pay. This exclusion

ONLY applies to the student, not their spouse or dependents under accompaniment statuses. Individuals in

F-2 or J-2 immigration status are never exempt from FICA (Social Security and Medicare Taxes)

If Social Security or Medicare taxes are withheld from pay that is not subject to these taxes, contact the

employer who withheld the taxes in error for a refund. The employer would also be eligible for a refund of

their portion of the erroneously withheld taxes.

If that employer does not refund the withheld taxes, file Form 843, Claim for Refund and Request for

Abatement and attach supporting documentation for reimbursement.

See Publication 519, Chapter 8, Paying Tax Through Withholding or Estimated Tax, for a list of items to

attach as supporting documentation. Mail Form 843 (with attachments, including Form 8316, Information

Regarding Request for Refund of Social Security Tax) to the following address:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0038

What Form(s) to File

Form 8843: If any of the following applies: If you are a nonresident alien, excluding days of presence in

the United States for purposes of the substantial presence test because you:

• were an exempt individual (temporarily in the United States as a teacher or trainee in “J” or “Q”

immigration status; temporarily in the United States as a student in an “F”, “J”, “M”, or “Q” immigration

status; or you were a professional athlete competing in a charitable event, or

• were unable to leave the United States as planned because of a medical condition or problem.

• meet the qualifications of Rev. Proc. 2020-20 for COVID-19 travel restrictions.

Even if the student or scholar had no income, they still must file Form 8843 by the 15th day of the 6th

month after your tax year ends (June 15th) and file one for each family member who is in the U.S. also

excluding days of presence. (The test for residency must be applied separately for each individual under

the above immigration statuses).

If Canadian students are exempt individuals and do not have a visa, use the information from their work

authorization papers to complete Form 8843. Form 1040-NR: For all filing of income and/or treaty benefits.

31

When to File

Taxpayers will have until April 15, 2024 to file their 2023 return.

If you did not receive wages subject to U.S. income tax withholding, or are filing a standalone Form 8843,

file your return by the 15th day of the 6th month after the tax year ends (June 15th).

When the regular due date for filing falls on a Saturday, Sunday, or legal holiday, file by the next

business day.

Extensions of time to file - If you cannot file your return by the regular due date, file Form 4868,

Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

For the 2023 calendar year, the due date is April 15, 2024 making any extension due October 15, 2024

(December 16, 2024 if the due date of your return is June 17, 2024).

You must file the extension by the regular due date of your tax return and pay any tax due with the

request for extension.

Amended Returns - If you later have changes in your income, deductions, or credits after you file your

return, file Form 1040-X, Amended U.S. Individual Income Tax Return. Also use Form 1040-X if you

should have filed Form 1040 instead of Form 1040-NR or vice versa.

If you amend Form 1040-NR or filed a previous Form 1040-X, attach the most recently filed form to the

correct Form 1040-X. Print “Amended” across the top of the attached corrected forms or schedules.

If you are claiming a refund, the amended return must be filed within 3 years from the date the return was

filed or within 2 years from the time the tax was paid, whichever is later.